Government Registrations

Government registrations are essential processes that businesses and individuals undergo to ensure compliance with legal requirements and to gain official recognition from the governing authorities. These registrations vary depending on the nature of the entity and its activities, encompassing aspects such as taxation, licensing, permits, and certifications. By obtaining proper registrations, entities demonstrate their commitment to operating within the bounds of the law and contribute to fostering trust and transparency in the marketplace. Compliance with government registrations not only safeguards against legal repercussions but also opens doors to accessing various benefits and opportunities provided by the government. Easypaytax facilitates this crucial compliance.

NSIC Registration Process

NSIC registration is a way of formalizing your business and getting listed in the NSIC database. The government of India set up the NSIC to support people who run small businesses. The MSMEs registered with NSIC are eligible for support under many governmental developmental programs. Easypaytax guides you through this beneficial process.

The government introduced NSIC registration to support small businesses struggling in today's economy. The purpose of NSIC is to give organizations access to benefits from big-ticket purchases made by the government.

Registering for NSIC and getting the registration certificate is easy, but it can be confusing if you are unaware of all the necessary details. This article covers the NSIC registration process, fees, and more. It gives you all the information you need to register online and get your NSIC certificate without delay. Go through this article and learn how to get registered under NSIC today.

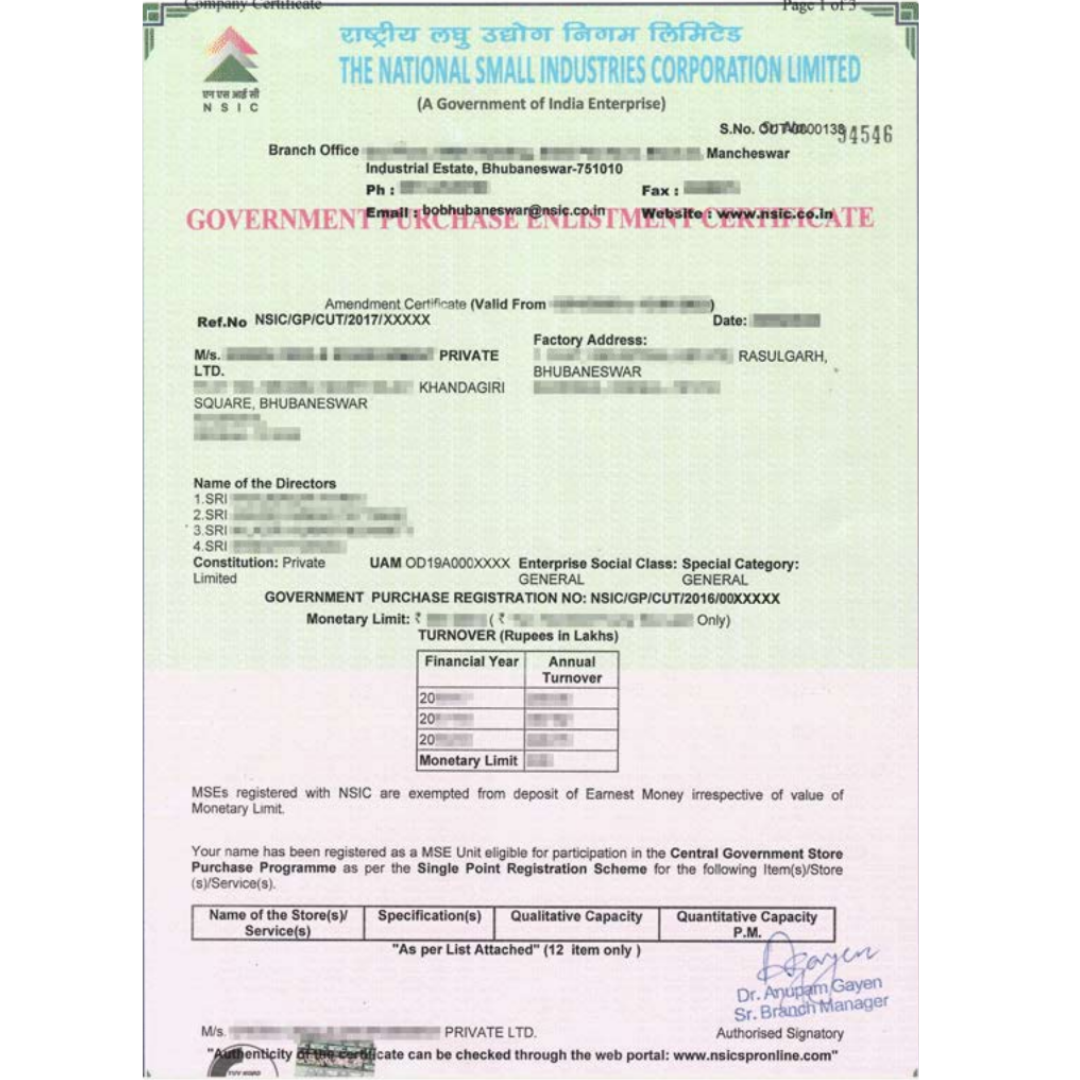

NSIC Registration Certificate Sample

Documents Required For NSIC Registration

For Proprietorship

- PAN Card of Proprietor

- UAM / Udyam Registration

- Details of Plant & Machinery

- Copy of ownership document of the premises or copy of Lease deed/Rent Deed

- List of quality control equipment and testing facilities available in factory

- Latest Electricity Bill Copy

- Financial Details of the last 3 years, duly signed by the authorized person under his seal

- Face of Audited Balance Sheet

- Profit and Loss A/cs

- Schedule of Fixed Assets

- Schedule of Revenue for Operations

- Statement showing the Results of Operation for the last 3 years duly signed by Chartered Accountant

- Bankers’ Report giving details of financial status of the applicant firm as per Proforma

- Declaration signed by the applicant MSE Unit accepting conditions of registration

For Private/Public Limited Company

- PAN Card

- UAM / Udyam Registration

- Details of Plant & Machinery

- Copy of ownership document of the premises or copy of Lease deed/Rent Deed

- List of quality control equipment and testing facilities available in factory

- Latest Electricity Bill Copy

- Financial Details of the last 3 years, duly signed by the authorized person under his seal

- Face of Audited Balance Sheet

- Profit and Loss A/cs

- Schedule of Fixed Assets

- Schedule of Revenue for Operations

- Statement showing the Results of Operation for the last 3 years duly signed by Chartered Accountant

- Bankers’ Report giving details of financial status of the applicant firm as per Proforma

- Declaration signed by the applicant MSE Unit accepting conditions of registration

- List of Directors & their Share Holding

- MoA & AoA

- Board Resolution

For Partnership Firm

- PAN Card

- UAM / Udyam Registration

- Details of Plant & Machinery

- Copy of ownership document of the premises or copy of Lease deed or rent deed

- List of quality control equipment and testing facilities available in factory

- Latest Electricity Bill Copy

- Financial Details of the last 3 years, duly signed by the authorized person under his seal

- Face of Audited Balance Sheet

- Profit and Loss A/cs

- Schedule of Fixed Assets

- Schedule of Revenue for Operations

- Statement showing the Results of Operation for the last 3 years, duly signed by a chartered accountant

- Bankers’ Report giving details of financial status of the applicant firm as per Proforma

- Declaration signed by the applicant, MSE Unit, accepting conditions of registration

- Partnership Deed

- General Power of Attorney as per Annexure A(1)

For Industrial Co-operative Societies

- PAN Card

- UAM / Udyam Registration

- Details of Plant & Machinery

- Copy of ownership document of the premises or copy of Lease deed/Rent Deed

- List of quality control equipment and testing facilities available in factory

- Latest Electricity Bill Copy

- Financial Details of the last 3 years, duly signed by the authorized person under his seal

- Face of Audited Balance Sheet

- Profit and Loss A/cs

- Schedule of Fixed Assets

- Schedule of Revenue for Operations

- Statement showing the Results of Operation for the last 3 years duly signed by Chartered Accountant

- Bankers’ Report giving details of financial status of the applicant firm as per Proforma

- Declaration signed by the applicant MSE Unit accepting conditions of registration

- List of Members

- Copy of Registration of Society

- Resolution of Authorization

- Name of Executive Body

For Hindu Undivided Family

- PAN Card

- UAM / Udyam Registration

- Details of Plant & Machinery

- Copy of ownership document of the premises or copy of Lease deed/Rent Deed

- List of quality control equipment and testing facilities available in factory

- Latest Electricity Bill Copy

- Financial Details of the last 3 years, duly signed by the authorized person under his seal

- Face of Audited Balance Sheet

- Profit and Loss A/cs

- Schedule of Fixed Assets

- Schedule of Revenue for Operations

- Statement showing the Results of Operation for the last 3 years duly signed by Chartered Accountant

- Bankers’ Report giving details of financial status of the applicant firm as per Proforma

- Declaration signed by the applicant MSE Unit accepting conditions of registration

Authorization of Karta

For Limited Liability Partnership

- PAN Card

- UAM / Udyam Registration

- Details of Plant & Machinery

- Copy of ownership document of the premises or copy of Lease deed/Rent Deed

- List of quality control equipment and testing facilities available in factory

- Latest Electricity Bill Copy

- Financial Details of the last 3 years, duly signed by the authorized person under his seal

- Statement showing the Results of Operation for the last 3 years duly signed by Chartered Accountant

- Bankers’ Report giving details of financial status of the applicant firm as per Proforma

- Declaration signed by the applicant MSE Unit accepting conditions of registration

- Copy of incorporation document

- LLP Agreement (Form-3)

- Copy of Form 4: – Names of partners and changes, if any, made therein

- Copy of Form 2 (It shows the location of the main or registered offices of the LLP, details of all the partners, statements etc)

- Copy of Form 8: – Statement of Account and Solvency – The Statement of Account & Solvency.

- Copies of Form 11: – Annual Return

- General Power of Attorney as per Annexure A(1)

For Trust

- PAN Card

- UAM / Udyam Registration

- Details of Plant & Machinery

- Copy of ownership document of the premises or copy of Lease deed/Rent Deed

- List of quality control equipment and testing facilities available in factory

- Latest Electricity Bill Copy

- Financial Details of the last 3 years, duly signed by the authorized person under his seal

- Statement showing the Results of Operation for the last 3 years duly signed by Chartered Accountant

- Bankers’ Report giving details of financial status of the applicant firm as per Proforma

- Declaration signed by the applicant MSE Unit accepting conditions of registration

- List of Members

- Copy of Registration of Trust

- Resolution of Authorization

- Name of Executive Body

How To Register under NSIC

The registration process is simple and can be done online. Easypaytax will guide you. You will need to provide basic information about your business and pay a registration fee. Once you are registered, you will be issued an NSIC certificate.

- Step 1. Udyam Registration:

Udyam Registration Number is required to apply for NSIC registration. Therefore, the primary step of NSIC certification is MSME registration.

- Step 2. Registration for MSME DataBank:

MSMEs must register in MSMEDataBank using UAM No. and PAN to apply for Single Point Registration.

- Step 3. Application for NSIC Registration:

The application for Single Point Registration is done online on the NSIC website. All the required forms, annexures, and documents must be uploaded properly. After applying, the NSIC forwards the application to a zonal branch or sub-branch office nearest to the applicant to complete the unit’s technical inspection and forwarding of recommendation for NSIC registration.

- Step 4. Third-party Inspection:

Inspection by a third-party agency is involved for store item inspection. The units must choose an inspection agency according to their domain expertise and jurisdiction. To check the Inspection charges, refer to the list of Inspecting Agencies empanelled for technical inspection under SPRS.

- Step 5. Approval & Issuance of NSIC Certificate:

On receiving the inspection report from the agency, NSIC grants registration to the MSE unit. Post-approval, the NSIC Registration Certificate will be available online, and the respective NSIC office will send a physical copy of the certificate by post.

Eligibility for NSIC registration

- A business must be a small or medium-sized enterprise (SME) with an annual turnover of less than Rs. 100 crores to apply for NSIC registration.

- In addition, the business entity must be registered with the Registrar of Companies (ROC) and have a minimum net worth of Rs. 25 lakhs.

- MSMEs that have already begun commercial production (Startups) but have not completed one year of operation are eligible for Provisional Registration for one year. After one year, MSMEs can apply for complete registration.

- Note: Provisional registration certificate is valid for one year and issued to MSME with a limit of Rs. 5 Lakh.

- Micro & Small Enterprises (MSMEs) having Udyog Adhaar Memorandum (UAM) and possessing their workshop or on lease basis are eligible for registration.

- Any manufacturer or service provider with a valid GST number and meeting the above criteria can apply for NSIC registration online.

- Eligible firms must have commercial and technological advancements to provide services to government agencies like defense, railways, PSUs, and central and state government departments.

- Traders are not eligible for registration under the NSIC schemes.

Employees State Insurance

TThe Employees' State Insurance (ESI) Scheme is a comprehensive social security scheme designed to protect the interests of employees in India. Established under the ESI Act, 1948, it provides financial and medical benefits to employees and their dependents in cases of sickness, maternity, disablement, or death due to employment injury. Managed by the Employee State Insurance Corporation (ESIC), the scheme covers various sectors and establishments, ensuring the welfare of workers across the country. It encompasses a wide range of healthcare services, including medical treatment, hospitalization, and even cash benefits during periods of inability to work. The ESI Scheme stands as a crucial pillar in ensuring the well-being and security of the labor force in India, and Easypaytax assists with its compliance.

Employees State Insurance Scheme at a glance

The ESI Scheme applies to factories and other establishments, namely Road Transport, Hotels, Restaurants, Cinemas, Newspaper, Shops, and Educational/Medical Institutions, wherein:

- 10 or more workers (20 or more in some states) are working, and

- Drawing Salary/wages up to Rs. 21,000/- per month.

ESI Corporation has extended the benefits of the ESI Scheme to the workers deployed on construction sites located in the implemented areas under the ESI Scheme with effect from 1st August 2015. Under the ESI Scheme:

- Employees contribute 4.75% of the wages.

- Employees' Contribution is 1.75% of the wages.

- Employees earning less than Rs. 137/- a day as daily wages are exempted from payment of their share of contribution. Employers will, however, contribute their own share in respect of these employees. Easypaytax ensures accurate calculation and timely remittances.

Legal requirement of Employer towards Employees State Insurance Scheme

For starting up a business in the United Kingdom, we will require the following documents and information:

- Comply Rule & Take Registration:

It is a Statutory obligation of employers to whom the ESI Scheme applies under the ESI Act, 1948, to comply with the provisions of the Act and Register their Factory/Establishment under the ESI Act within 15 days from the date of its applicability. Easypaytax facilitates this.

- Enrol Eligible Employee:

Enrolment of all eligible employees on its rolls (regular or contractual) – wages up to Rs 21,000 at the time of joining the establishment. And take a printout of the Temporary Identity Certificate (TIC). On linking Aadhar with the IP insurance number, TIC will automatically be converted into a Permanent Identity Card (PIC). With PIC, the IP and his family members can avail benefits under the ESI Scheme, without any hitch.

- ESI Contribution:

Employer contributes 4.75% of salary (Basic +DA+ Retaining allowance) and Employees Contribution 1.75% which is deducted from employee’s salary deposit with ESI Account within the due date. Easypaytax assists with timely calculations and deposits.

- File Monthly Return:

Every month Employer files ESI returning online with details of Employee, salary, and ESI contribution amount within the due date.

- Remittance of Monthly ESI:

The total amount of contribution (Employer and Employee) is to be deposited in any branch of SBI by ONLINE generation of a challan through the ESIC portal using his credentials. ESIC has facilitated payment of ESI Contribution online by employer via the payment gateway of 58 banks in addition to SBI.

- File Half Yearly Return:

Easypaytax also supports the filing of half-yearly returns.

- Maintenance of records:

For ESI compliance, the employer must maintain the following records:

- Wage records and books are maintained under other laws.

- Accident Register in new Form-11 and

- An inspection book.

The immediate employer is also required to maintain the Employees’ Register for the employees deployed to the principal employer. Easypaytax suggests preserving records for at least 7-10 years, though there is no specific time limit in the PF Act.

Documents requirement for Employee State Insurance Registration

- Permanent Account Number (PAN)

- Digital Signature of Employer

- Bank Details (Cancelled Cheque)

- List of Eligible Employees with Salary breakup

- Address Proof (COI/Telephone/Electricity/Water bill)

- Partnership Deed (for Partnership Firm)

- Memorandum and Articles of Association of the Company

- Factory License/Shop & Establishment Registration Certificate

Registration process of Employees State Insurance

For starting up a business in the United Kingdom, we will require the following documents and information:

- Employer Signup: For new employer registration, the first step is to Sign up on the ESIC website with Company Name, Principal Employer, State, Region, Email ID, and Mobile No.

- Get User ID and Password to Login: An email is sent to the user after successful sign-up along with login credentials at the registered Email ID.

- Select Unit type: Once you Login and process for New Registration, select your Establishment Type: 1) Factory or 2) Shop Establishment and Proceed for next.

- Prepare Application Form: Fill up all the Information one by one in Form-01. Put Employee Details Gender-wise Total (Employed Directly or Through Contractor).

- Upload Documents and Attach DSC: Once the Application fill up is complete and all particulars correctly disclosed in the form, the next task is to upload all relevant documents and attach DSC of the employer.

- Pay Advance &/or Submit: Finally, submit the form and View/Print the Registration Letter (C-11), which is also sent to your Email ID.

Barcode Registration

"Barcode registration" refers to the process of officially recording barcode information with a relevant authority or organization. Barcodes are unique identifiers used to track products, assets, or inventory. Registering barcodes ensures their authenticity and legality in the marketplace. This registration process typically involves submitting detailed information about the product, including its name, description, manufacturer, and barcode symbology. Once registered, the barcode can be used for various purposes, such as inventory management, retail sales, and supply chain tracking. Registering barcodes helps prevent duplication and counterfeit products, ensuring accurate and efficient tracking throughout the distribution and sales process. Easypaytax simplifies this vital process.

Barcode of Products at a glance

A barcode is “A machine-readable code in the form of numbers and a pattern of parallel lines of varying widths, printed on and identifying a product.”

The lines and patterns on a barcode are representations of numbers and data, and their development allowed basic information about a product to be easily read by an optical scanning device (a barcode scanner) and automatically entered a computer system. This massively reduces the time to record product information and eliminates human data entry error.

Barcode systems help businesses and organizations track products, prices, and stock levels for centralized management in a computer software system, allowing for incredible increases in productivity and efficiency.

Barcodes started out with simple 1-dimensional designs, consisting of basic black lines that could only be read by specially designed barcode scanners. However, today barcodes come in many shapes and sizes and have a wide range of designs, and many can even be read by mobile phones and other devices.

Documents requirements for Barcode Registration in India

- PAN Card of the Applicant Entity (for Proprietorship entity, PAN of Proprietor)

- GST Registration Certificate (Optional – required in case of GST Registered)

- Request Letter for Barcode allotment (on Company Letterhead)

- Copy of Audited Balance Sheet

- Certificate of Incorporation (Company/LLP)

- Partnership Deed (for Partnership Firm)

- Memorandum and Article of Association (for Company)

- Cancelled Cheque Copy

What are the Different types of Barcodes?

Different applications require different barcodes with the capability to hold varying data. Therefore, to serve diverse requirements, Barcode system standards are used for that distinction between barcodes. Different types of barcode symbols also distinguish between different barcodes. Barcodes can be categorized into the following categories:

- EAN/UPC FAMILY BARCODES

EAN/UPC (European Article Number/Uniform Product Code) Family of barcodes are instantly recognizable barcodes that are printed on virtually every consumer product in the world. They are the longest-established and most widely used of all barcodes. Used for Retail stores for sales checkout, inventory, etc.

- DATABAR FAMILY BARCODES

DataBar barcodes are often used to label fresh foods. These barcodes can hold information like an item’s batch number or expiry date, in addition to other attributes used at the point-of-sale such the item weight.

- 1D BARCODES

128 and ITF-14 are highly versatile 1D barcodes that enable items to be tracked through global supply chains. The 128 barcodes can carry any of the ID keys, plus information like serial numbers, expiration dates and more. The ITF-14 barcode can only hold the Global Trade Item Number (GTIN) and is suitable for printing on corrugated materials.

- 2D BARCODES

Two-dimensional (2D) barcodes look like squares or rectangles that contain many small, individual dots. A single 2D barcode can hold a significant amount of information and may remain legible even when printed at a small size or etched onto a product. 2D barcode could do much more than just keep track of assets and inventory.

Today, 2D codes, especially QR codes, which can hold as much as 7,000 digits or 4,000 characters of text, are used by companies to share information or websites and videos with consumers, or by healthcare facilities to monitor medication, and even to integrate data with programs like MS Office, MS SQL Servers, and other databases and files.

2D barcodes are used in a wide range of industries, from manufacturing and warehousing to logistics and healthcare.

MSME Registration

MSME Registration, short for Micro, Small, and Medium Enterprises Registration, is a crucial step for businesses aiming to avail themselves of the benefits offered by the government for small and medium-sized enterprises. This registration provides recognition to businesses and enables them to access various schemes, incentives, and support measures provided by the government. It not only facilitates easier access to credit but also opens doors to opportunities such as subsidies, exemptions, and preferences in government procurement. Overall, MSME Registration plays a significant role in fostering the growth and sustainability of small and medium enterprises, contributing to the economic development of the country. Easypaytax assists with this vital registration.

MSME Benefits

Major Benefits of Having an MSME Certificate or Udyog Aadhaar Certificate:

- 100% Collateral Free loans from all banks

- Reduction in interest rates from Banks

- 1% exemption on interest rate on OD

- Special consideration on International Trade fairs

- Bar Code Registration Subsidy

- Waiver in Security Deposit in Government Tenders and Departments

- Concession in Electricity bills

- Reimbursement of ISO Certification

- NSIC Performance and Credit ratings

- 50% subsidy for patent registration

Support services provided by State governments

- Extended credit facilities

- Industrial extension support and services

- Availability of developed sites for warehouse construction

- Provision of training facilities

- Hire-purchase of machinery for use in MSME

- Assistance in marketing, both within the country and outside (exports)

- Assistance with the construction of industries in underdeveloped areas

Technical consultancy, assistance in capital, and so on, for enhancement of technology in MSME

The salient features of the scheme include

- Enhancing the optimal eligibility loan from Rs. 25 lakhs to Rs. 50 lakhs.

- Reducing the one-time guarantee for loans availed of by the MSME in the North-Eastern region of India from 1.5% to 0.75%.

- Increasing the extent of guarantee cover from 75% to 80% for:

- Women operated medium and small-scale enterprises

- Micro enterprises, for loans up to 5 lakhs

- Loans obtained in Northeastern region of the country

- Reducing the one-time guaranteed fee for all loans availed in Northeastern India from 1.5% to 0.75%.

Tax Benefits

Depending on your business, you may enjoy an exemption scheme as well as exemption from certain direct taxes in the initial years of your business. Easypaytax can help identify applicable benefits.

Benefits of having MSME certificate

By having the MSME certificate, any business can apply and get many benefits and subsidies from various government departments including Electricity, and it is also very important in the tender application process.

Benefits from Banks

All banks and other financial institutions recognize MSMEs and have created special schemes for them. This usually includes priority sector lending, which means that the likelihood of your business being sanctioned a loan is high, and lower bank interest rates. There may also be preferential treatment in case of delay in repayment.

Startup India Registration

"Startup India Registration" refers to the process by which new businesses in India can officially register themselves under the government's Startup India initiative. This initiative aims to foster entrepreneurship and innovation by providing various benefits and support to startups. To register, startups need to meet certain criteria outlined by the government, such as being incorporated as a private limited company, partnership firm, or limited liability partnership. Once registered, startups can access benefits like tax exemptions, funding opportunities, and easier compliance procedures, which can significantly boost their growth and development. Overall, Startup India Registration serves as a crucial step for startups to avail themselves of government support and propel their journey towards success. Easypaytax is your partner on this journey.

Startup India Registration -

The government of India launched the "Startup India Initiative" to ensure that the growing number of Startups in the country have the right resources and support to grow. Under the Startup India program, eligible companies can get recognized as Startups by DPIIT to get tax benefits, easier compliance, IPR fast-tracking, special benefits & more. Easypaytax provides comprehensive information on the Startup India Scheme benefits, registration process, required documents, and recognition fees for Startup India registration.

Startup India Certificate [Sample]

What is Startup india dpiit recognition?

The Startup India is a program to encourage and support the startup ecosystem in India. It aims to promote new businesses by providing them with various benefits & exemptions, such as tax holidays & access to government funding and incubator programs. The benefits of the program can be accessed by startups through DPIIT recognition, a process Easypaytax helps with.

Benefits of Startup India Recognition

DPIIT recognized Startups are eligible to get the following benefits under the Startup India Initiative:

- Self-Certification: Startups shall be allowed to self-certify compliance for 6 Labour Laws and 3 Environmental Laws through a simple online procedure to reduce the regulatory burden on Startups and keep compliance costs low.

- Tax Exemption under 80-IAC: Pvt Ltd Companies and LLPs are exempted from paying income tax for three consecutive financial years under Section 80-IAC out of their first ten years since incorporation.

- Easy Winding of a Company: As per the Insolvency and Bankruptcy Code, 2016, Startups with simple debt structures or those meeting certain income-specified criteria can be wound up within 90 days of applying for insolvency.

- Fast-tracking of Startup Patent Applications: Patent applications filed by Startups shall be fast-tracked for examination to realize their value sooner.

- Rebate on filing of Patent Application: Startups shall be provided an 80% rebate on patent filing costs to help them pare costs in the crucial formative years. The objective is to reduce the cost and time taken for a Startup to acquire a patent, making it financially viable to protect their innovations and encourage them to innovate further.

- Easier Public Procurement Norms: DPIIT recognized Startups can register on GeM as sellers and sell their products and services directly to Government entities. It is a great opportunity for Startups to participate in the public procurement process and access another potential market for their products. Moreover, entities can apply for NSIC registration to act as an assessed vendor on GeM. DPIIT recognized Startups are exempted from submitting Earnest Money Deposit (EMD) or bid security while filling government tenders. The Government shall also exempt Startups in the manufacturing sector from the criteria of “prior experience/ turnover” without any compromise on the stated quality standards or technical parameters.

- Exemption under Section 56: Investments into eligible Startups by Accredited Investors, Non-Residents, AIFs (Category I), & listed companies with a net worth more than ₹100 crores or turnover more than ₹250 crores are exempted under Section 56(2) (VIIB) of Income Tax Act. Also, consideration of shares received by eligible Startups shall be exempt up to an aggregate limit of ₹25 crores.

- Panel of facilitators to assist in filing of IP applications: The Central Government will bear the entire fees of the facilitators for any number of patents, trademarks, or designs that a Startup may file. The Startups must bear the cost of the statutory fees only.

- GeM Portal preference: Recognized startups are given preference on GeM portal to boost the startup ecosystem in India.

Eligibility for startup India registration

- Originality of the entity: The business entity/startup must be a new entity; it should not be split off from an existing company.

- Type of business structure: To get the startup India registration, the business should be registered under the following forms of business:

- Private Ltd Company

- One Person Company

- Partnership Firm

- Limited Liability Partnership

- Annual Turnover: As per the guidelines of DPIIT, the business entity should have an annual turnover of less than 100 crore rupees.

- Incorporation Period: To get recognized under the DPIIT startup India initiative, the entity should not be older than 10 years from the day of its incorporation.

Innovation & Scalability: The entity must be innovative and scalable. It’s one of the most important criteria to be considered by DPIIT before startup India registration. Because the aim of the program is to promote innovation and generate business and jobs in the country. Easypaytax helps assess your eligibility.

Documents required for DPIIT recognition

The following documents are needed to be submitted by the entities for recognition of Startup India by DPIIT. Easypaytax helps compile these:

- Authorization Letter

- Company’s PAN Card

- Certificate of Incorporation

- Director’s Aadhaar & PAN card

- Passport-size photograph of the directors

- Website or company’s profile deck (if available)

- Photo & video of products/services

- Brief write-up on how the business is working towards:

- Innovation in the industry

- High potential for wealth creation

- Potential for employment generation

- Other certificates, if required:

- GST registration

- Trademark registration

- Copyrights registration for IPR

- MSME registration, if available

Startup India registration process

The startup India registration process with Easypaytax is simple and hassle-free. These are the details you need to provide to get your business registered under the Startup India certificate through DPIIT registration:

- Details & Documentation:

Entities are required to provide all asked details to get their startup registered under the Startup India initiative on the startup portal.

- Drafting & Uploading Documents:

Once all the documents and details are collected, the drafting process for the startup India portal registration will be initiated by our experts.

- Application for startup India registration:

Once the drafting and creation of the entity profile are completed on the startup India registration portal, the application for DPIIT recognition will be raised from the startup India portal dashboard.

- Verification by DPIIT:

The application for consideration of acknowledging the entity as a legitimate startup will be initiated by the authorities. Depending upon the criteria of startup India registration, the application will be acknowledged by the DPIIT.

- Approval & rejection of application:

Once the application is submitted to The Department for Promotion of Industry and Internal Trade (DPIIT), it would take around 20-25 days to get startup India registration approval from the authorities. The application might also be rejected if it does not fulfill the criteria for registration set by DPIIT. Easypaytax navigates this process for you.

Drug License Registration in India

"Drug License Registration in India" is a crucial process that ensures the safety and quality of pharmaceutical products circulating in the market. Governed by the Drugs and Cosmetics Act, 1940, and the Rules thereunder, this registration mandates adherence to strict guidelines and regulations. It involves thorough scrutiny of manufacturing facilities, product quality, labeling, and distribution practices. Obtaining a drug license is mandatory for entities engaged in the manufacturing, distribution, and sale of drugs and pharmaceuticals in India. This regulatory framework aims to safeguard public health by ensuring that only safe and effective medications reach consumers. Easypaytax provides comprehensive support for this registration.

Drug License Registration in India at glance -

For any Individual/Corporate/Partnership Firms etc., it is mandatory to obtain a valid Drug Licence from concerned State Authorities (Drugs Control Department). The provisions for this have been made in the Drugs and Cosmetic Act 1940 and Rules 1945 applicable in India. Easypaytax guides you through the requirements:

- Basic pre-requisites for a Drug License:

- Minimum area of the Office/Shop.

- Granted in the commercial premises or other premises independent of residence.

- Refrigerator or Air Conditioner on the premises.

- Needs to comply with the conditions of licence of the issuing Authority.

- Displayed at business premises.

- A technical staff: A registered pharmacist or competent person with same line experienced as approved by the Department of Drug Control.

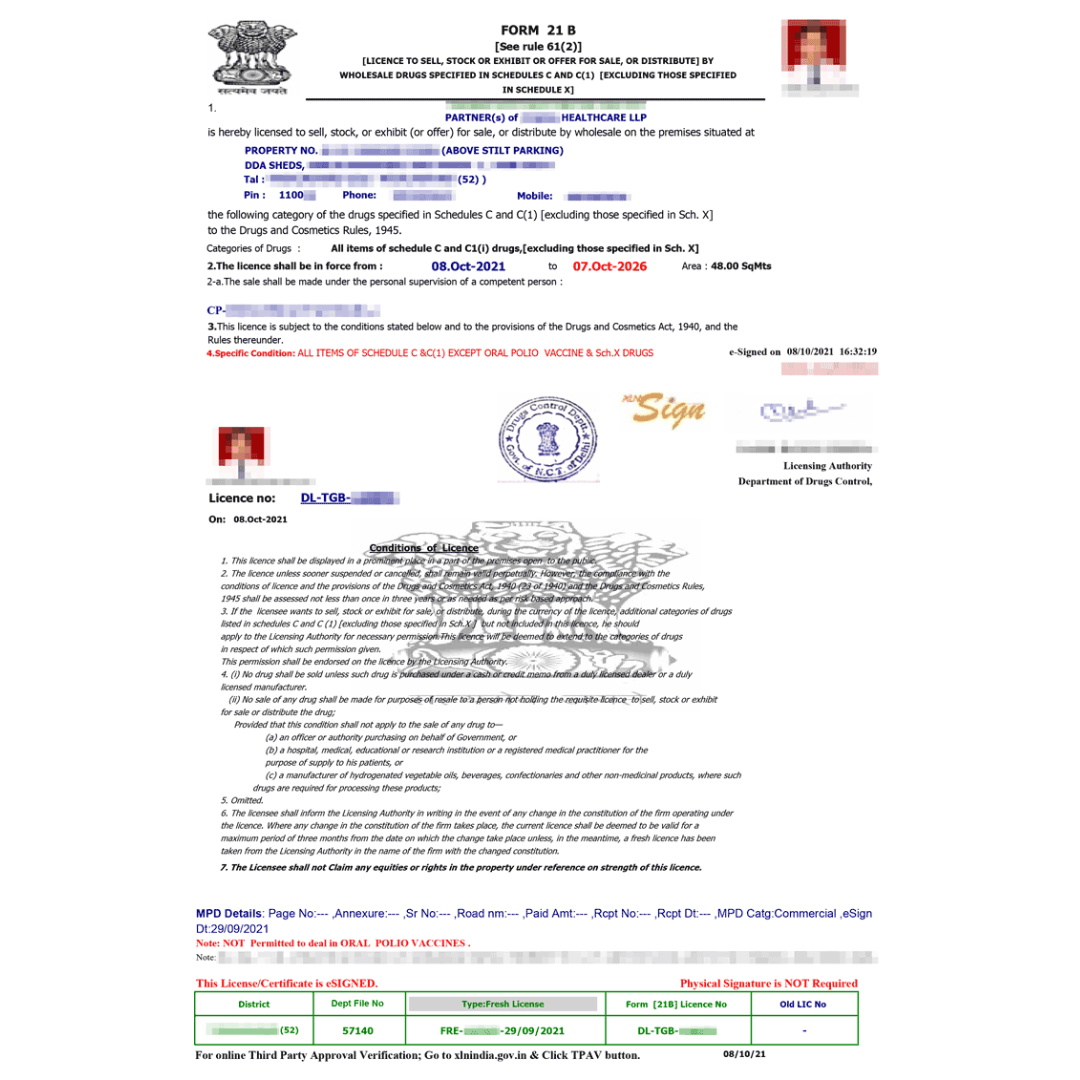

Form-20B

Form-20B

Documents requirement for Drug License in India

- The firm’s constitution (MOA & AOA for Company and Partnership Deed for Firm/LLP)

- For Retail & Wholesale license – Affidavit from the Regd. pharmacist/competent person

- Property Paper (Registry Deed/Lease Deed/POA in case of owned Property)

- Board Resolution, List of Directors, Certificate of Incorporation (in case of company)

- The key plan and the site plan of the premises (Blueprint).

- One Invoice copy of Refrigerator/Air conditioner purchased for use

- Copy of Rent agreement (in case of rented premises)

- Covering Letter stating purpose of the Application

- ID proof of Directors/Partners/Proprietor

- For Manufacturing – Affidavit from employer and or Technical Staff for full time working with the firm

- For Manufacturing – List of Technical Staff and their proof of Education Qualification, Experience Certificate, Biodata, Appointment Letter, three photographs.

- In case of Retail License: Registered Pharmacist’s degree certificate, Registration certificate with State Pharmacy Council and Appointment Letter and Biodata.

- In case of Wholesale License: Competent person’s degree certificate, Experience Certificate in medicine job and Appointment Letter and Biodata.

- For manufacturer – Affidavit of Non-Conviction, List of Equipment and Machineries for manufacturing and List of Equipment Provided for Testing

Drug License Registration process in India ( General Instruction)

- Login ID and Password

Applicant must obtain user ID and Password by giving request letter in person with the details of the firm.

- Online Application

Please be sure that all the information is filled in precisely for the respective applications mentioned below and only then e-send the application. In case of rejection of your application for incomplete information, the fees once paid will be forfeited.

- Upload Documents

All the documents should be scanned in 100 dpi & black and white and then should be uploaded using the said ID and Password at the space provided for the purpose. The licensing authority may ask for any other specific documents if required.

- Physical Inspection

Show all the original documents to the inspector at the time of inspection. The Inspector may ask you for any further documents relevant to your application.

- Approval/Rejection

After grant or rejection of your application, you will receive an SMS about the same. Take a printout of the approval/rejection from ‘Print License’ option for fresh license and renewal and click ‘MISC approvals’ for other approvals within 3 days. You will receive licenses/approvals with the valid e-signature and official seal.

- Change in constitution

If the proprietor/partner are changed, it will be treated as ‘change in constitution’ and the applicant will have to obtain a fresh license.

- Separate Password for Pharmacists

Registered Pharmacists are also required to update their details by obtaining a separate password. Easypaytax assists throughout this entire process.

EPF Registration

"EPF Registration" refers to the process of registering for the Employees' Provident Fund (EPF) scheme, which is a social security initiative by the government aimed at providing financial stability and security to employees after retirement. It is mandatory for organizations with a certain number of employees to register for EPF. This registration involves obtaining a unique Employer Identification Number (EIN) and complying with EPF rules and regulations regarding contributions, withdrawals, and other related matters. EPF registration ensures that employees receive benefits such as retirement pensions, insurance, and provident fund withdrawals, thereby promoting financial well-being and social security in the workforce. Easypaytax streamlines this critical registration.

Concept of PF

The Employee Provident Fund is a perk given by the employer to their employees over and above their basic remuneration

What is Employees Provident Fund (EPF)

PF is one of the primary platforms of savings for the working class in India. An Establishment or business is mandatorily required to obtain an EIN No. if the total employee strength is 20 or more. The total strength of employees includes contractors or temporary employees like housekeeping staff, daily wage workers, security, or other temporary workers in the business. Even if a company has an employee strength of less than 20, the company can still apply for EIN. The Provident Fund Registration certificate should be obtained within 30 days from the date of completing 20 employees. Easypaytax assists with meeting these requirements.

What is the rate of PF Contribution?

- 12% of Basic Salary of Employee deposited directly towards EPF

- 12% of Employer contribution is divided as –

- 8.33% of contribution towards Employees’ Pension Scheme

- 3.67% of contribution towards Employees’ Provident Fund

- 1.1% of contribution towards EPF Administration Charges (After 01/04/2017 0.65%)

- 0.5% of contribution towards Employees’ Deposit Linked Insurance (minimum RS. 500/-)

- 0.01% of contribution towards EDLI Administration Charges (After 01/04/2017 RS. 0/-)

Documents Required For EPF Registration

- PAN Card copy of firm/company/society/trust

- Partnership deed (In case of partnership)

- Cancelled cheque (bearing pre-printed company / firm name & Current Account No)

- Certificate of Registration (In case of Proprietorship/ Partnership/ Company / LLP)

- Certificate of incorporation (In case of company/ society, trust/ NGO)

- Copy of PAN Card of Directors / Partner

- Copy of Aadhaar Card/ Voter identity card of Director

What is the rate of PF Contribution?

- 12% of Basic Salary of Employee deposited directly towards EPF

- 12% of Employer contribution is divided as –

- 8.33% of contribution towards Employees’ Pension Scheme

- 3.67% contribution towards Employees’ Provident Fund

- 1.1% of contribution towards EPF Administration Charges (After 01/04/2017 0.65%)

- 0.5% of contribution towards Employees’ Deposit Linked Insurance (minimum RS. 500/-)

0.01% of contribution towards EDLI Administration Charges (After 01/04/2017 RS. 0/

WHAT ARE THE BENEFITS OF PF REGISTRATION?

- Risk coverage: The most fundamental benefit of the Provident Fund is covering the risks employees and their dependents that may arise due to retirement, an illness, or their demise.

- Uniform account: One of the most important aspects of the Provident Fund account is that it’s steady and transferable. It can be carried forward to any other place of employment.

- Employee Deposit Linked Insurance Scheme: This scheme is for all the PF account holders. According to it, 0.5% of the salary is deducted from the life insurance premium.

- Long-term goals: There are many long-term goals such as Marriage or higher education that require the urgent availability of funds. The accumulated PF amount often comes in handy during such occasions.

- Emergency needs: There are certain unanticipated occasions like marriage or other family occasions, any mishappening or illness that require urgent finance. The PF amount can be of great help.

- Covers pension: Apart from the employee’s 12% contribution towards EPF, an equal amount is contributed by the employer, which includes 8.33% towards Employee Pension Scheme (EPS).

What are the different Provident Fund forms?

- EPF Form 11

- EPF Form 19, 10C, 31(New)

- EPF Form 19

- EPF Form 13 Transfer Form

- EPF Form 31 Advance from the Fund

- EPF Form 20, 10-D, 5IF(NEW)

- EPF Form-10C

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.