Proprietorship Firm Registration

Registering a proprietorship firm involves setting up a business under the sole ownership of an individual. This model is ideal for solo entrepreneurs or small businesses due to its simplicity and low cost. The process generally includes obtaining the necessary permits and licenses based on jurisdiction, along with meeting legal requirements such as tax registrations. While it gives full decision-making power to the owner, it also carries unlimited personal liability for debts and obligations. In essence, proprietorship firm registration is the first essential step toward operating a legally recognized business.

Proprietorship Firm Registration

A sole proprietorship is the most basic form of business structure in India. It is owned, controlled, and operated by a single individual and remains the easiest and most accessible form of business registration.

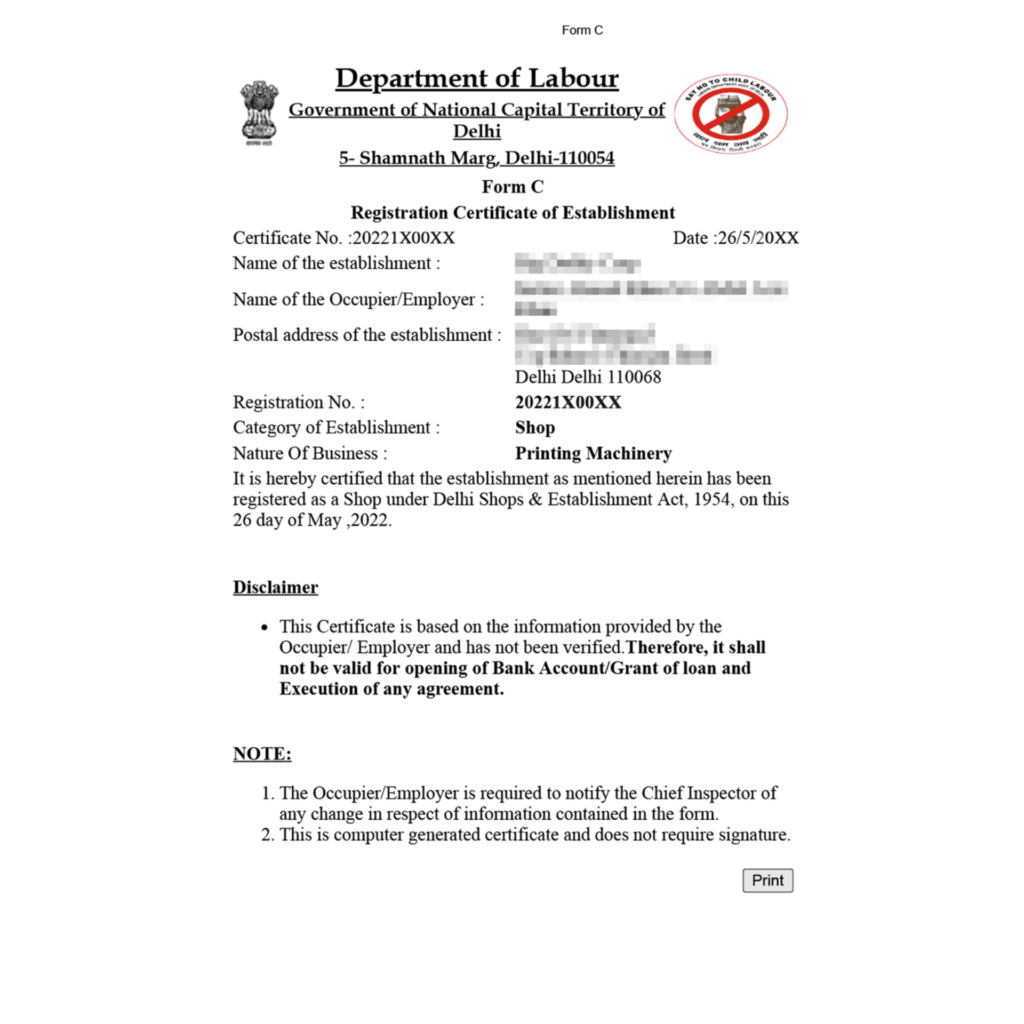

Shop License

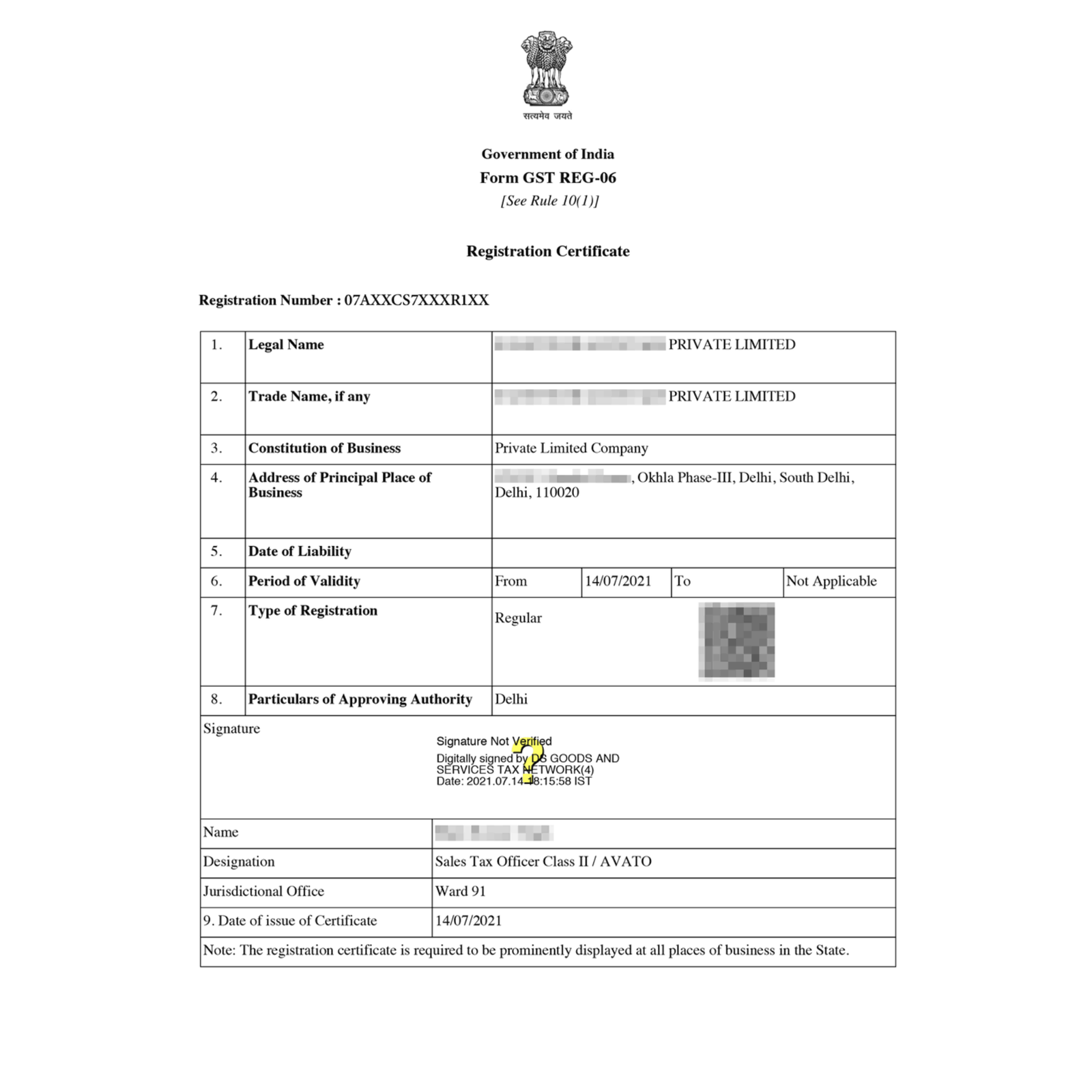

GST Certificate

MSME Certificate

Benefits of Proprietorship Firm Registration

Let’s look at some notable advantages of registering a proprietorship firm in India:

Minimal Compliances:

Proprietorship firms require fewer legal compliances than an OPC, making them more attractive for independent business owners.

Easy to Start:

Since it doesn’t fall under any specific legislation, a sole proprietorship can be started without any formal registration making it the quickest way to launch a business.

Lower cost:

Due to fewer compliance rules, there’s no need for costly professional services such as audit, reducing administrative expenses.

Complete control:

As the business is owned by one individual, the proprietor enjoys full control over operations and decision-making with no external interference.

Procedure of Sole Proprietorship Firm Registration

Step 1. Application for GST Registration

Based on your business activity and GST laws, apply for GST registration. This process usually takes 5–10 working days, depending on the department's response time.

Step 2. MSME Registration

To establish your firm’s legal identity and access government incentives, register under the MSME Act as a Small or Medium Enterprise. This registration can help in availing low-interest loans and scheme benefits.

Step 3. Application for Shop and Establishment License

According to your state’s labor laws, apply for a shop and establishment license from the local municipal body. This license is based on the number of employees or workers engaged.

Step 4. Bank Account Opening

Once the above steps are completed, you’ll need to open a current account in the firm’s name. Easypaytax can assist you in seamlessly setting up your business bank account.

Registrations required for Sole Proprietorship Firm

1. GST Registration

2. MSME Registration

3. Shop and Establishment Act License

Documents required for Sole Proprietorship Registration

1. Copy of Aadhar Card

2. Copy of PAN Card

3. Address proof of office

Procedure of Sole Proprietorship Firm Registration

Step 1: Application for GST Registration

Based on your business activity and GST laws, apply for GST registration. This process usually takes 5–10 working days, depending on the department's response time.

Step 2. MSME Registration

To establish your firm’s legal identity and access government incentives, register under the MSME Act as a Small or Medium Enterprise. This registration can help in availing low-interest loans and scheme benefits.

Step 3. Application for Shop and Establishment License

According to your state’s labor laws, apply for a shop and establishment license from the local municipal body. This license is based on the number of employees or workers engaged.

Step 4: Bank Account Opening

Once the above steps are completed, you’ll need to open a current account in the firm’s name. Easypaytax can assist you in seamlessly setting up your business bank account.

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.