Section 8 Microfinance Company Registration

Section 8 Microfinance Company Registration refers to the process of registering a microfinance company under Section 8 of the Companies Act. Easypaytax guides you through this. Section 8 companies are non-profit organizations established for promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, or any other similar objective. Registering a microfinance company under Section 8 involves fulfilling specific legal requirements, including drafting a memorandum and articles of association, obtaining necessary approvals from regulatory authorities, and adhering to regulations governing microfinance activities. This registration ensures compliance with the law and enables the microfinance company to operate legally while focusing on its mission of providing financial services to underserved communities and promoting socio-economic development.

Section 8 Microfinance Company Registration

A Section 8 microfinance company, often known as a microfinance institution (MFI), is a financial organization that offers loans to individuals and organizations who are unable to access traditional financial institutions owing to poverty, occupation, ethnicity, religion, or nationality. Easypaytax can help you establish one.

A microfinance company is registered with the Registrar of Companies under Section 8 of the Indian Companies Act, 2013. As a result, it falls under the jurisdiction of the Ministry of Corporate Affairs.

The primary goal of the Section 8 corporation is to promote arts, sports, commerce, science, religion, social welfare, charity, and environmental preservation. Section 8 companies can be registered as either private or public limited companies.

At Easypaytax, our team of specialists will assist you with registering your Section 8 business in a timely and efficient manner, without you having to worry about the documentation or the registration procedure. We will handle all the documentation and registration procedures and complete the incorporation in the most effective manner possible, thanks to our years of expertise in company registration.

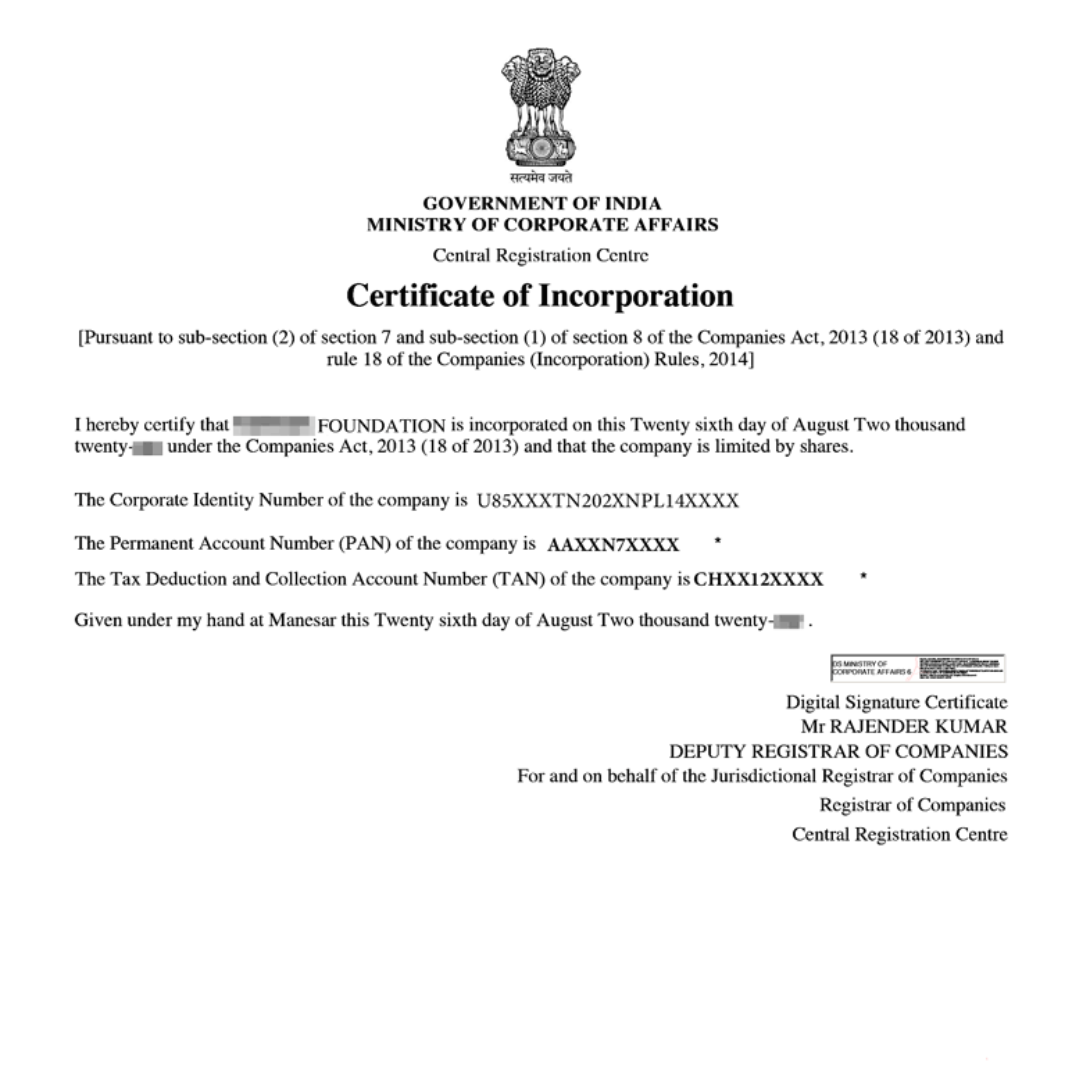

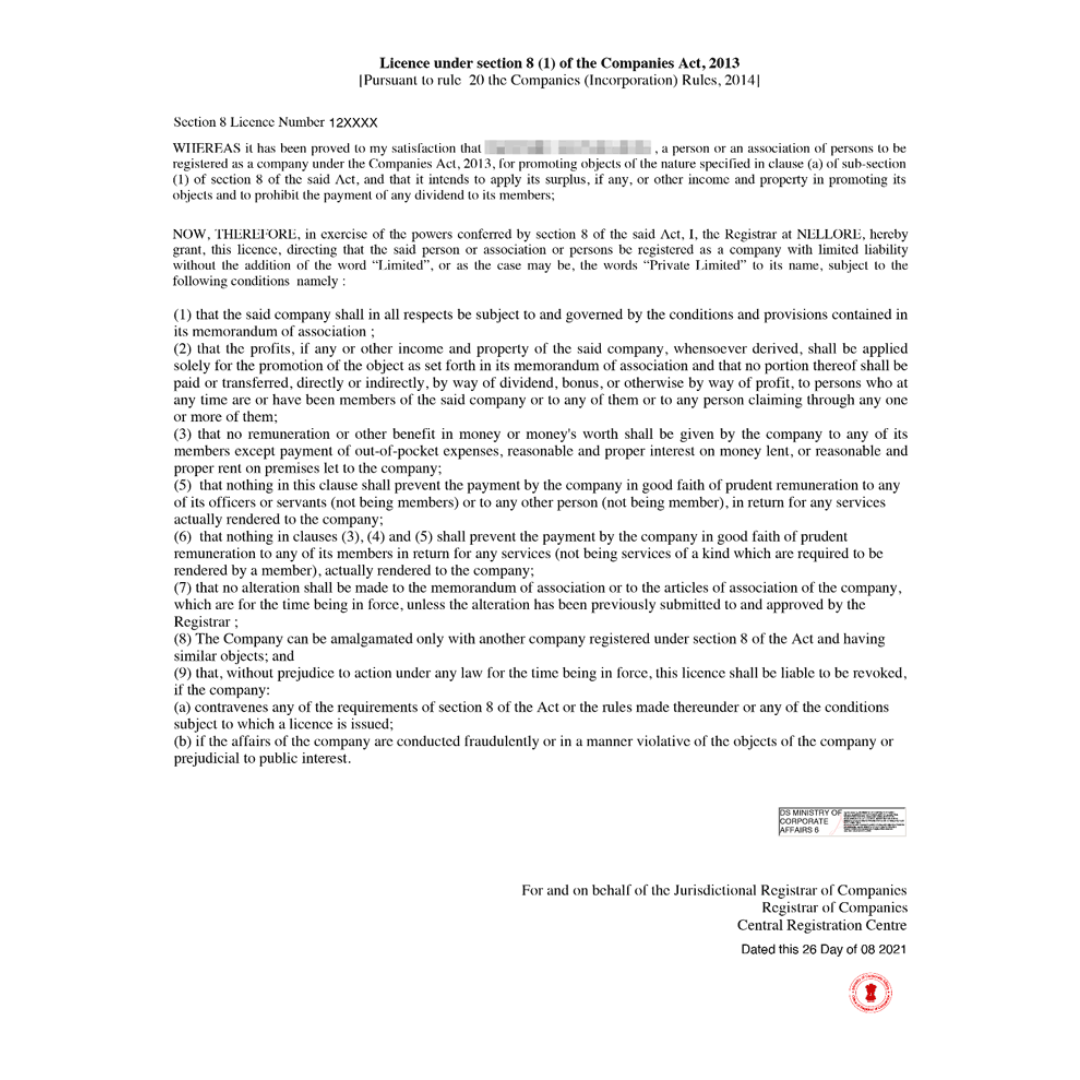

Section 8 Company Sample Documents

Incorporation Certificate

Section 8 License

What is a Section 8 Microfinance Company?

Section 8 Microfinance firms are financial institutions that give loans to low-income individuals. These firms were established to improve the credit system for small enterprises that are unable to obtain loans from banks owing to the complexity of their processes. Easypaytax understands these needs.

As a result, it is also known as a microcredit or microbenefit organization. Microfinance firms are the easiest businesses to create since they may give unsecured loans without RBI clearance at interest rates of up to 26% per year.

Section 8 corporation compliances as a microfinance enterprise are the same as usual, with the addition of filing the MBP-1, a service Easypaytax can assist with.

Benefits of Section 8 Microfinance Company

- No RBI Approval required

- Can lend Unsecured loan

- No Demographic Barrier

- Best Rate of Interest

- Minimum capital not required

- Defaulters can be sued for non-payment

- Limited Compliances

Documents required for Section 8 Microfinance Company

- PAN & Aadhar Card of both the directors

- Bank Statement with the address of both the directors (not older than 2 months)

- Passport Size Photo

- Email address & Phone number

- Utility Bill of the premises

Definition of Microfinance Loan

1.A microfinance loan is defined as a collateral-free loan given to a household having annual household income up to ₹3,00,000. For this purpose, the household shall mean an individual family unit, i.e., husband, wife, and their unmarried children.

2.All collateral-free loans, irrespective of end use and mode of application/ processing/ disbursal (either through physical or digital channels), provided to low-income households, i.e., households having an annual income up to ₹3,00,000, shall be considered as microfinance loans.

3.To ensure the collateral-free nature of the microfinance loan, the loan shall not be linked with a line on the deposit account of the borrower.

4.The REs shall have a board-approved policy to provide the flexibility of repayment periodicity on microfinance loans as per borrowers’ requirements.

Process of Section 8 Microfinance Company registration

Step 1: Obtain Digital Signature Certificate (DSC)

To form a company, you must apply for the digital signature certificate of the designated directors of the proposed company. All the documents for Section 8 companies are filed online, and e-forms must be digitally signed. Easypaytax assists designated directors to obtain their DSCs from certifying agencies.

Step 2: Apply for Name Approval

The next step is to apply for name approval. The name must suggest that it is registered as a Section 8 company. While making the name application for the company, the industrial activity code and object clause of the company must be defined. Easypaytax helps ensure compliance here.

Step 3: File SPICe Form (INC-32)

After the name approval, details concerning the company’s registration have to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. Easypaytax can assist with this filing.

Step 4: File MoA and AoA with “Finance” Objective

SPICe e-MoA and e-AoA are the linked forms to be drafted when applying for company registration. Easypaytax ensures these are correctly filed.

Step 5: Issuance of Incorporation Certificate

Post-approval of the documents from the Ministry of Corporate Affairs, PAN, TAN & Certificate of Incorporation will be issued from the department concerned. Easypaytax will guide you through this final step

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.