12A & 80G Registration

12A and 80G registrations are crucial for non-profit organizations in India to avail tax benefits and attract donations. Easypaytax offers expert assistance for these registrations.

- 12A Registration: It grants tax exemption to the organization on its income. This ensures that the organization doesn't have to pay taxes on its income, allowing it to utilize more funds for its charitable activities.

- 80G Registration: It allows donors to claim tax deductions for the donations made to the registered organization. This incentivizes individuals and corporates to contribute towards the social causes supported by the organization.

12A & 80G Registration Process -

12A & 80G Registration ensures that the income of an organization is exempted from Income Tax if an NGO has this registration. If an organization has obtained certification under section 80G of the Income Tax Act, then donors of that NGO can claim exemption from Income Tax. Application for registration under section 12AB and 80G can be applied just after the registration of the NGO.

Applications for registration under 80G and 12AB can be applied together or can be applied separately. If an organization wants to apply for both registrations separately, then the application for registration u/s 12AB would be applied first. Getting 12AB registration is mandatory for application of registration u/s 80G of Income Tax Act, 1961.

At Easypaytax, our team of experts will help you register your 12A & 80G in a seamless manner without you being worried about the documents and registration process. We will take care of all the documents and registration requirements and do the incorporation in the most efficient way due to our years of experience in Company registration.

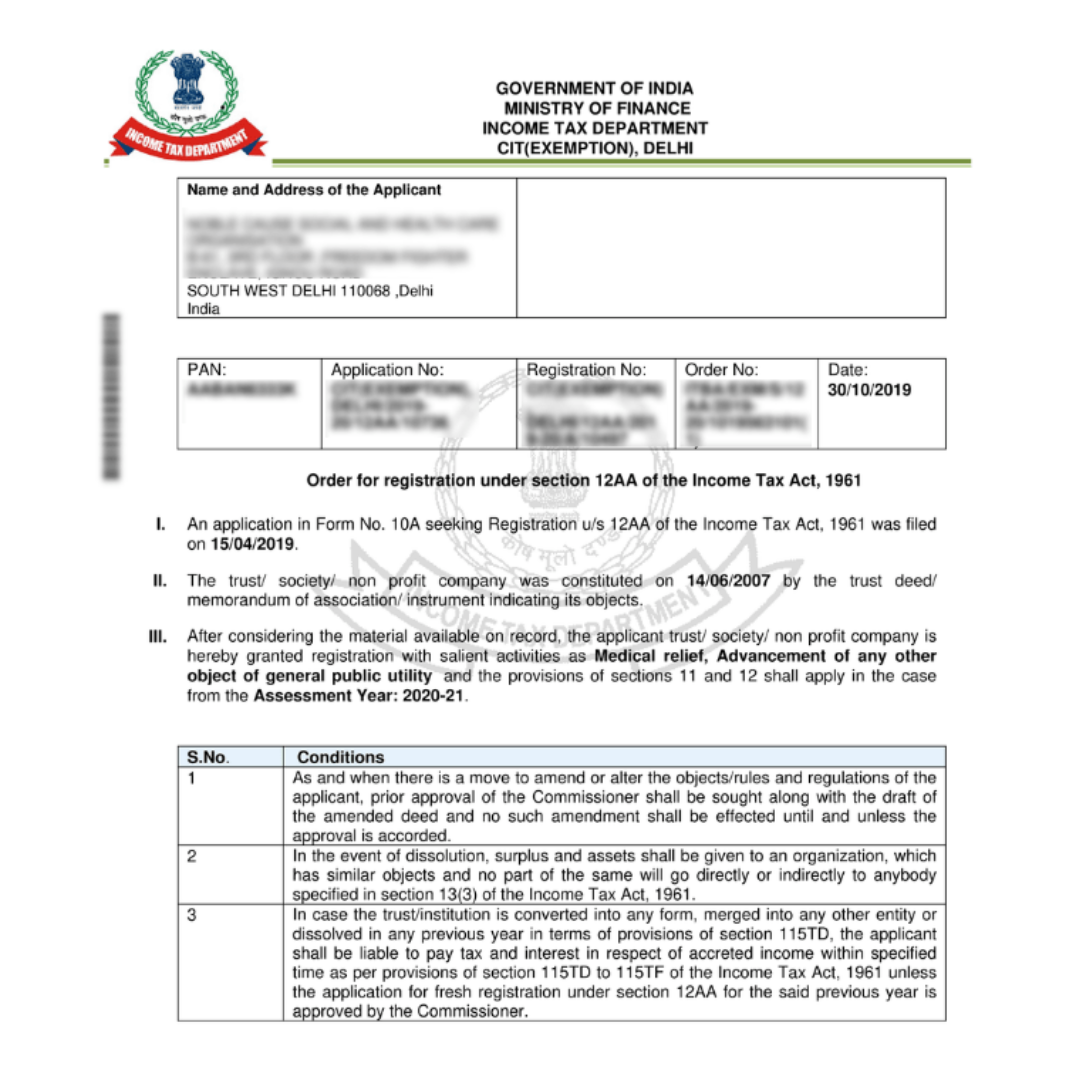

12AA Sample

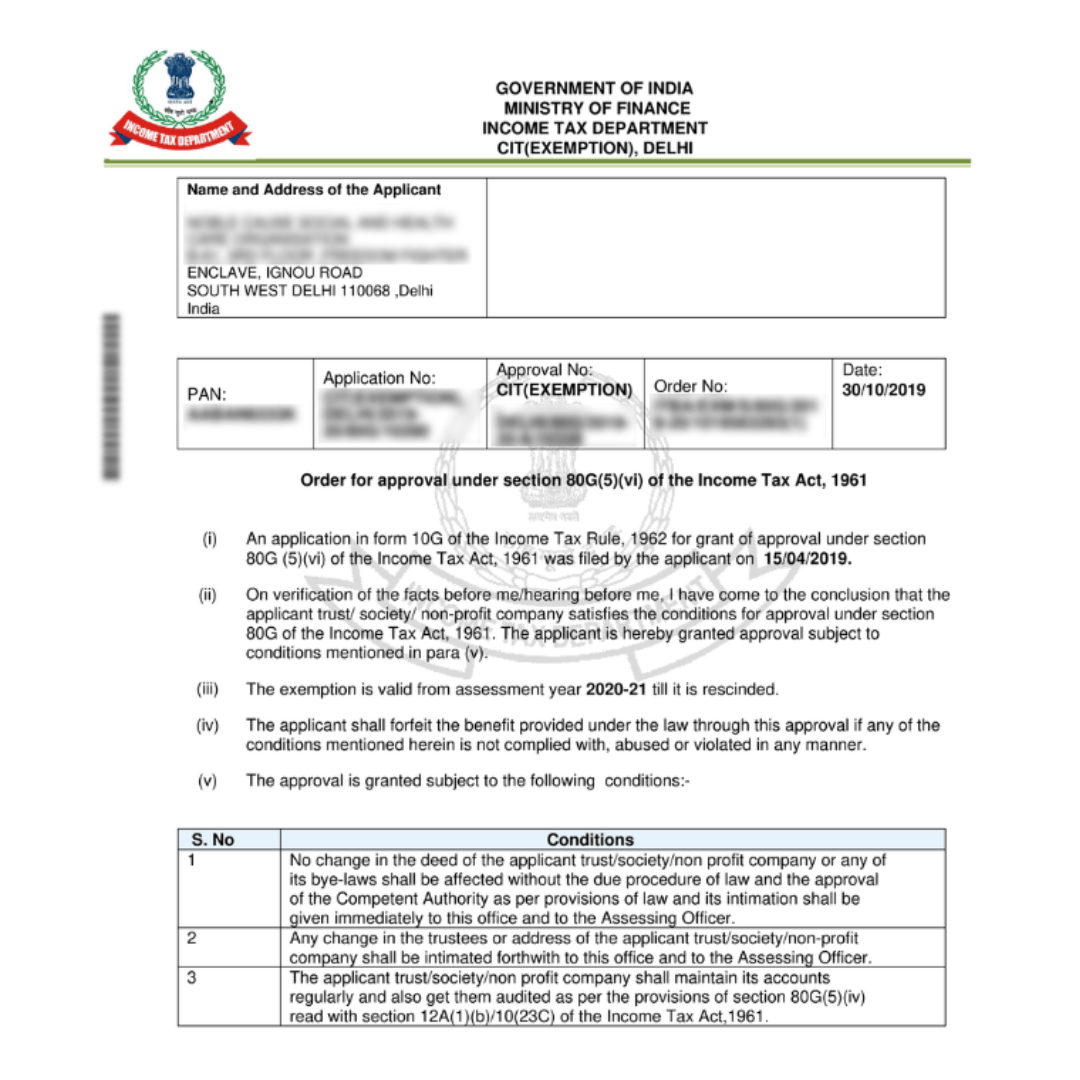

80G Sample

Documents required

What are the documents Required for 12A Registration?

- Copy of PAN of the NGO

- Registration Certificate & MoA in case of Section 8 Company

- Trust Deed in case of a Trust

- Form 10A for registration u/s 12A

- Form 10G for registration u/s 80G

- Address proof where the organization is registered

- Copy of Utility bills like electricity bill, water bill, etc.

- Books of accounts of past three years or since inception

- Activity and Progress/Project Report for past three years

- List of donors along with their details

- Bank account statement for the last three years.

Minimum Requirements for 12A & 80G Registration

Here is the list of minimum requirements for 12A & 80G registration:

- The organization must be a registered NGO

- Registration under Section 80G can be applied only after Section 12A registration

- NGO should not have any income generated from a business

- The organisation must maintain a regular book of accounts in favor of their receipts and expenses

Registration Process

12A Registration Process

- The application for Form 12A can be submitted online by submitting Form 10A on the Income Tax website incometaxindaiaefiling.nic.in. Easypaytax assists with online submission.

- The Form Section 12A can be accessed on the Income tax website under the Income Tax Forms Section, which is accessible through an e-file menu accessible upon login to the website.

- On receiving the application for registration, the Commissioner verifies the documents and genuineness of the NGO activities. He may call for additional documents and other information which he considers important or necessary.

- After verification, the Commissioner passes an order in writing for the grant of 12A Registration. If the Commissioner is not satisfied, he will reject the application, after which the applicant is provided with a fair chance to be heard

80G Registration Process

- Application for 80G registration is made in Form 10G. It must be filed with proper documents to the Jurisdictional Principal Commissioner or Income Tax Commissioner (Exemptions).

- Easypaytax ensures correct filing. On receiving the application for registration, the Commissioner verifies the documents and genuineness of the NGO activities. He may call for additional documents and other information which he considers important or necessary.

- After verification, the Commissioner passes an order in writing for the grant of 80G Registration. If the Commissioner is not satisfied, he will reject the application, after which the applicant is provided with a fair chance to be heard.

NGO Darpan Registration

"NGO Darpan Registration" is a government initiative in India aimed at providing a unified platform for NGOs (non-governmental organizations) to register and showcase their details. It facilitates transparency and accountability in the NGO sector by allowing organizations to voluntarily register and maintain updated information regarding their activities, finances, and beneficiaries. This registration process helps in streamlining the interaction between NGOs, government agencies, and other stakeholders, fostering better collaboration and effective utilization of resources for social welfare and development initiatives. Easypaytax assists NGOs with this crucial registration.

What is NGO Darpan Registration

"NGO Darpan Registration" is a government initiative in India aimed at providing a unified platform for NGOs (non-governmental organizations) to register and showcase their details. It facilitates transparency and accountability in the NGO sector by allowing organizations to voluntarily register and maintain updated information regarding their activities, finances, and beneficiaries. This registration process helps in streamlining the interaction between NGOs, government agencies, and other stakeholders, fostering better collaboration and effective utilization of resources for social welfare and development initiatives. Easypaytax assists NGOs with this crucial registration.

What is NGO Darpan Registration (Easypaytax Explains)

NGO Darpan is a portal handled and maintained by NITI Aayog and the National Informatics Center. It serves as an interface between the government departments and the NGOs/VOs. This portal was earlier maintained by the Planning Commission, which was replaced with NITI Aayog in January 2015.

The Unique ID generated by registering on the portal is needed when NGOs/VOs wish to have government fundings, and all information related to schemes and policies of the Government. Easypaytax highlights its importance.

This, however, becomes mandatory in some cases when there is grant of funds by the Government Ministries and Departments. By Registering on NGO Darpan Portal, a unique ID is generated which further is needed at the time of filing FCRA registration form, Form-10A, and others also. The other government ministries and departments are also now giving recognition to NGO Darpan Registration.

This portal also helps in maintaining data and records of all the NGOs/VOs in the state which conclude with more transparency, efficiency, and accountability and greater partnership between the government and the voluntary sector

Eligibility for NGO Darpan Registration

Any VO / NGO which is registered as a trust/society/a private limited nonprofit company, under section-25 Company of the Indian Companies Act, 1956 are eligible to get registered under Niti Aayog. No individual can apply for NGO Darpan or NITI Aayog registration.

Documents Required for NGO Darpan Registration

Here is the list of documents required for NGO Darpan Registration for Non-Profit Organisations:

- Name of NGO

- Address proof of NGO

- Organisation PAN

- NGO Registration Certificate

- Details of members such as Name, Phone and address, Identity proof etc.

- Details of grants and donations received in last 5 years.

Details related to the working area or area of activities of an NGO.

NGO Darpan Registration Process

Step 1: Documentation

The very first step in almost every NGO Darpan registration process is the documentation. The NGO Darpan registration documents that are required while registering on the NGO Darpan are already discussed above. You must have them with you at the time of registration on the NGO Darpan portal. Easypaytax helps prepare these documents.

Step 2: Online Application

In this step, the process of online application for NGO Darpan registration starts. To login into the NGO official website, there is a requirement to generate login credentials. The online portal of NGO Darpan for the registration of NGOs is maintained by NITI Aayog.

Step 3: Provide Basic Details

The next step is filling up the details on the portal. Once you sign up, start adding the details for your NGO Darpan registration. The details required for NGO Darpan registration are NGO Registration Details, members’ Details, source of Funds, Key Contact Information, Working or Service areas

Step 4: Verification by the Department

When the details are verified and filled with your end, the next step involves the department verifying all those details. If found correct, then the department issues a UIN (Unique Identification Number), which is also called Darpan ID. It is displayed under the Unique ID Details section of your Darpan Login Account on NGO Darpan portal. Easypaytax ensures accurate submission for smooth verification.

CSR Registration

"CSR Registration" refers to the process by which companies formally register for Corporate Social Responsibility (CSR) initiatives. In many countries, including India, CSR has become a mandatory requirement for certain companies to allocate a portion of their profits towards socially beneficial projects. Registration typically involves submission of relevant documents and compliance with legal guidelines set by the government or regulatory bodies. By registering for CSR, companies demonstrate their commitment to giving back to society and participating in sustainable development efforts. Easypaytax provides comprehensive support for CSR compliance and registration.

CSR-1 Registration For NGO -

CSR registration with the Ministry of Corporate Affairs is important for all NGOs, irrespective of trust, society, or Section 8 company, to get CSR funds from corporations. CSR registration is not only important but also mandatory for NGOs that want to act as an implementing agency for CSR activities. The objective behind bringing all NGOs under one umbrella is to implement an efficient monitoring system for CSR spending. CSR-1 registration is completely online and can be done only with the certification of practicing CA, CS, or CMA. It takes only 2 days to get the CSR registration online, which costs only Rs. 2,500. After CSR registration and approval, NGOs can apply for registration on the CSR Exchange Portal after 30 days from the date of approval. Easypaytax makes this process simple.

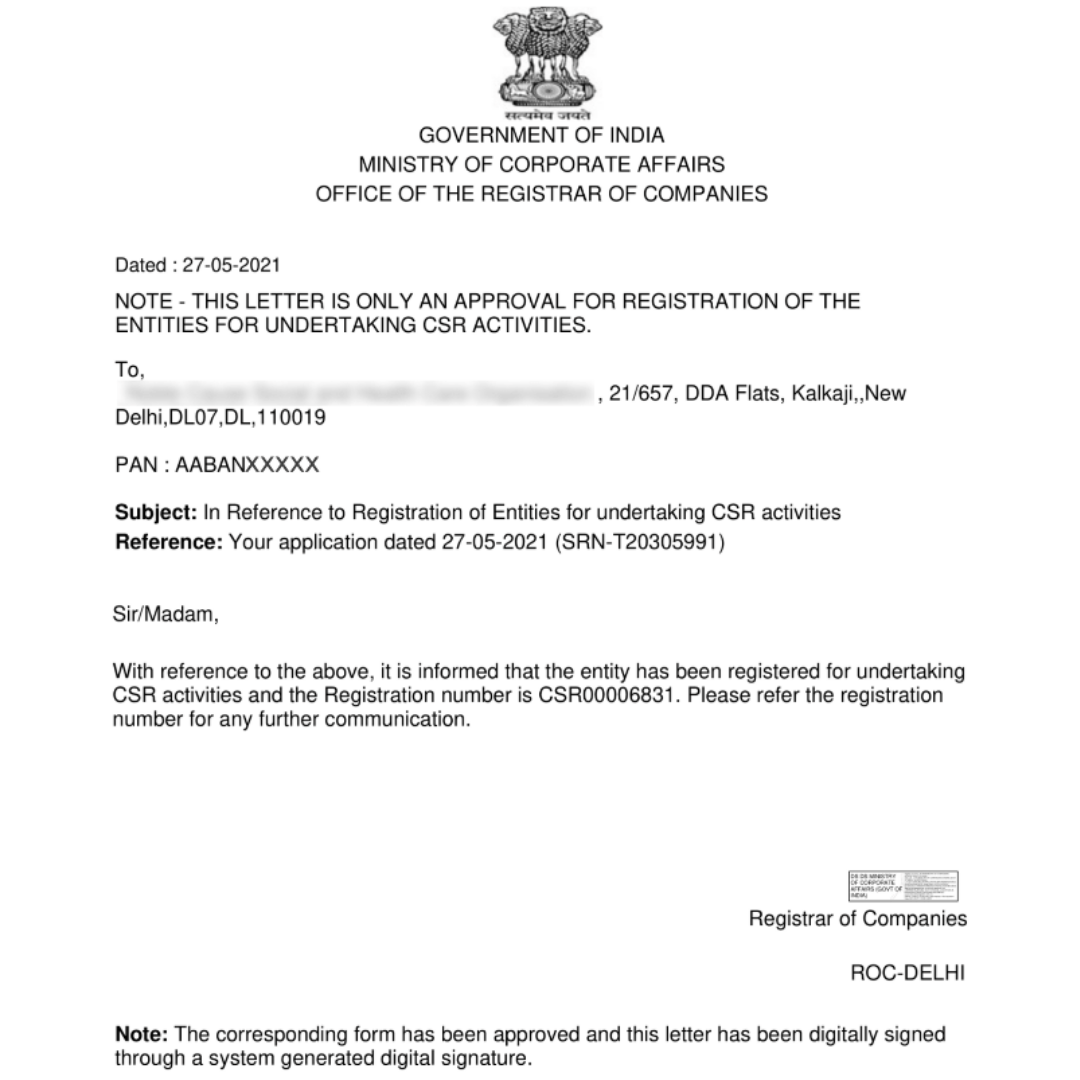

CSR-1 Approval Letter

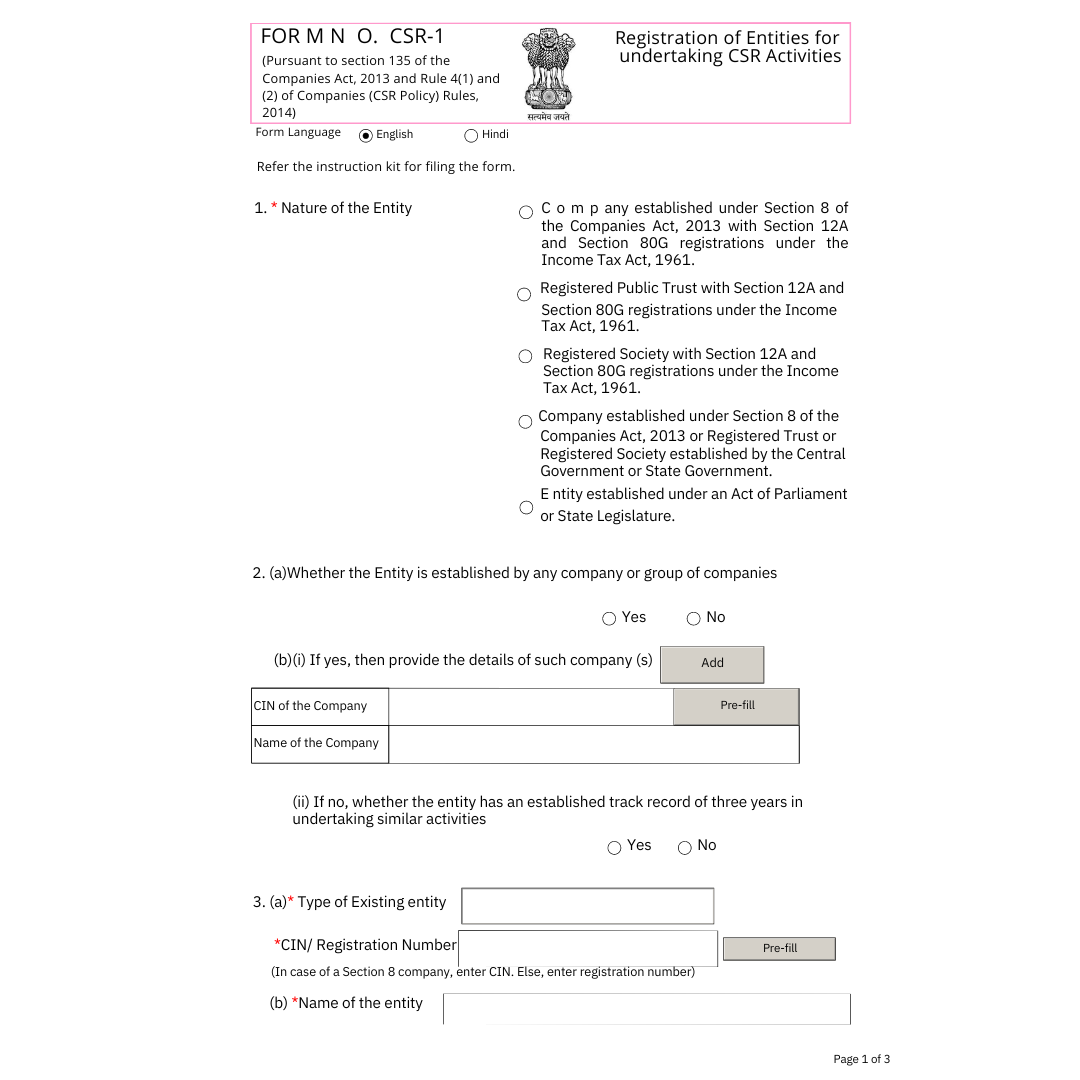

CSR-1 Sample Form

What is Form CSR-1?

Form CSR-1 or “eForm CSR-1” is a registration form for getting CSR funding. It is termed as Form for “Registration of Entities for undertaking CSR activities”. Form CSR-1 it shall be signed and submitted electronically by the entity.

It should be verified digitally by a practising professional like a Chartered Accountant or a Company Secretary, or a Cost Accountant. All entities who are intending to undertake CSR projects must file this Form on the MCA portal. Easypaytax assists with verification and filing.

Some of the benefits of CSR-1 registration are:

- Enhanced public image

- High authenticity of NGO

- Easy in undertaking CSR activities

- Entitled to receive Grants & Donation from companies

Importance of CSR-1 registration

The Ministry of Corporate Affairs has made the CSR-1 form available on its website and made it mandatory for all social organisations seeking CSR funds or CSR implementing agencies to file it. As per the notification issued by the Ministry of Corporate Affairs, from April 1, 2021, CSR Funding will be released only to the NGOs that are registered with MCA by filing Form CSR-1. Easypaytax emphasizes this critical requirement.

The provisions of the 2019 Amendment to the Companies Act, 2013 about Corporate Social Responsibility (CSR) came into force on January 22. As per the new provisions, every entity covered under sub-rule (1) that intends to undertake any CSR activity will have to register with the Central Government by filing the form CSR-1 electronically with the Registrar of Companies with effect from April 1, 2021. These sub-rules provisions shall not affect the CSR projects or programmes approved before April 1, 2021.

On the submission of the Form CSR-1 on the MCA portal, a unique CSR Registration Number shall be generated by the system automatically. In this way, a list of all implementing entities is maintained by the MCA, increasing the chances of timely fulfilment of proposed activities. This past performance record of implementing agencies can be referred to by the companies and help them decide their engagement for future CSR activities.

What are the Documents required for filing eForm CSR-1

- 12AB & 80G Registration Order Copy

- PAN Card of the NGO

- Email ID and Mobile Number

- DSC of chairperson & his PAN number

- Details of members of the organisation

- Registration Certificate in case of Section 8 Company

- Trust Deed in case of a registered Trust

- Memorandum in case of a registered Society

Form CSR-1 it needs to be digitally signed by following people:

- Anyone of the Directors of Section 8 Company

- Anyone of trustees of Registered Trust

- By Chairperson/Secretary in case of Registered Society

- Authorized Signatory in case of an entity established under an Act of Parliament or State Legislature

- A Practising Professional like Chartered Accountant in Practice or a Cost Accountant in Practice or Company Secretary in Practice

How to file CSR-1 form?

- Documentation: Easypaytax helps compile all necessary documents.

- Filing on MCA Portal: Easypaytax manages the online submission.

- Inspection of the Form: Easypaytax ensures accuracy for smooth inspection.

- Approval Letter from MCA: Easypaytax follows up for approval.

To register for CSR-1 in India, an NGO needs to follow these steps:

- Register with the Registrar of Companies (ROC).

- Once registered with the ROC, apply for CSR-1 registration with the Ministry of Corporate Affairs (MCA). Easypaytax provides end-to-end support for this.

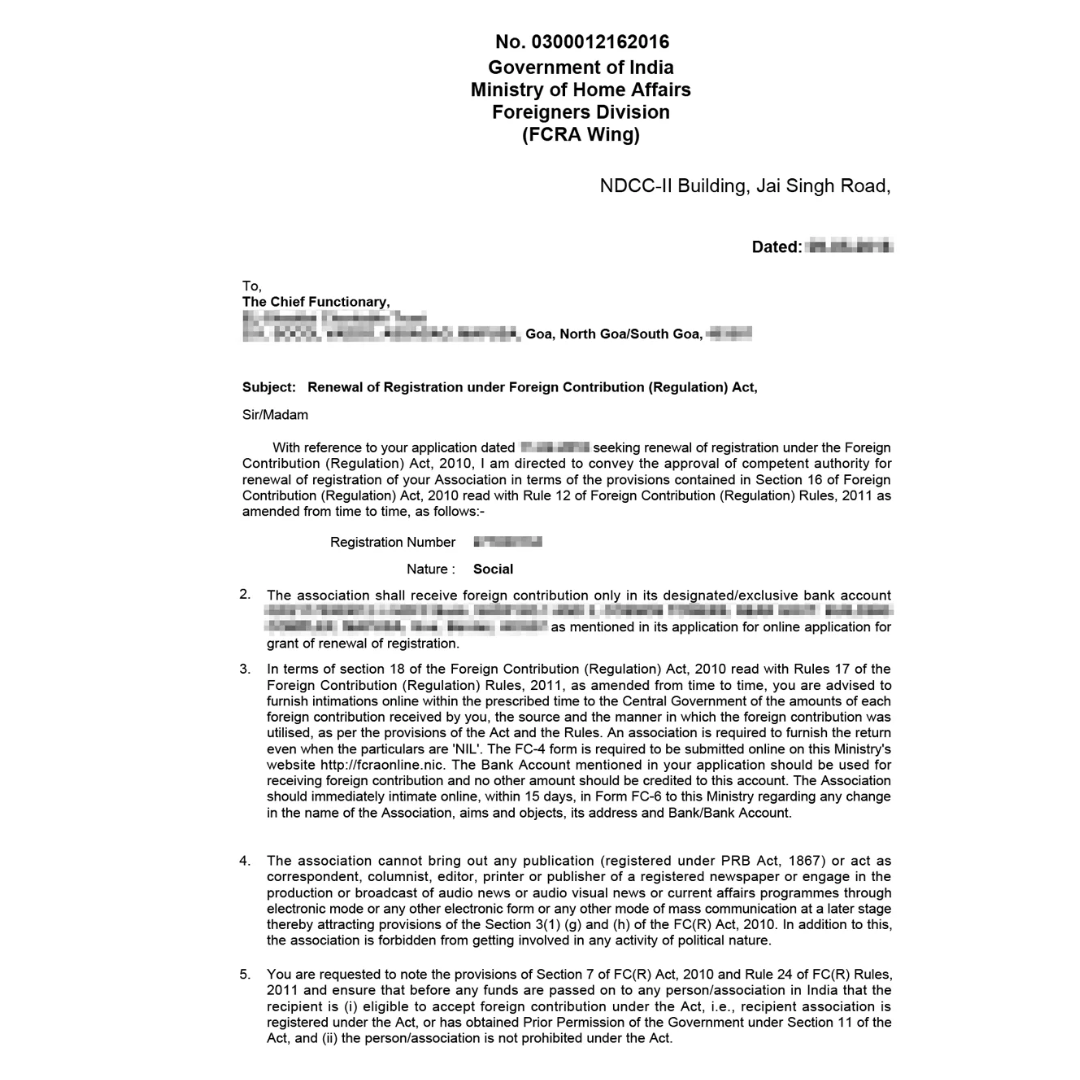

FCRA Registration for Foreign Donations -

"FCRA registration, or registration under the Foreign Contribution Regulation Act, is a crucial step for organizations seeking to receive foreign donations in India. This registration ensures transparency and accountability in the handling of foreign funds, as mandated by the Indian government. It also enables organizations to legally accept contributions from foreign sources for various social, cultural, educational, and charitable purposes. However, obtaining FCRA registration involves adhering to stringent guidelines and maintaining proper documentation to ensure compliance with the law. Overall, FCRA registration facilitates legitimate foreign contributions while safeguarding against misuse or mismanagement of funds. Easypaytax simplifies the complex FCRA compliance for NGOs."

FCRA Registration for Foreign Donations -

FCRA registration is a permit issued by the Ministry of Home Affairs to monitor the foreign donations received by Non-Profit Organisations in India. If you are a registered NGO, a Charitable Trust, or a Section 8 Company and wish to receive foreign donations, you must register under the Foreign Contribution Regulation Act (FCRA). Easypaytax assists with this mandatory registration.

Registration under FCRA helps charitable trusts and NGOs to get funds from foreign sources in their FCRA account. Non-Profit organizations in India that are providing necessary support to specific groups of people on a large scale are eligible to receive donations from the Foreign Funding Agencies.

Read on to learn everything about the FCRA, foreign contributions, and getting your organization registered under FCRA

FCRA Certificate Sample

What is FCRA?

FCRA stands for Foreign Contributions Regulation Act. It is a law that regulates the acceptance of foreign contributions. The law requires organizations in India to register with the state department before receiving any funds from sources outside the country.

Foreign Contribution Regulations Act was formed in 1976 with the objective of regulating the flow of foreign donations toward NGOs and Charitable Organisations in India.

Origin of the FCRA:

When the Emergency was declared in 1976, there were many fears of other countries interfering in India's affairs by pumping money into the country through separate organizations. These worries are older than one might think; they had been discussed in Parliament as early as 1969. To consolidate these rules (regarding the use of foreign funds) and prohibit their usage for activities deemed other than that of national interest. Implementation of this Act granted more control and scrutiny to the government over the transactions of NGOs from foreign sources.

Eligibility criteria for FCRA registration?

In order to register under the Foreign Contribution Regulation Act (FCRA), the Association must fulfill the following criteria:

- The FCRA registration guidelines require that the Association should be a non-profit organization and must be registered under one of the Indian societies laws:

- The Indian Societies Registration Act, 1860 or

- The Indian Trusts Act, 1882 or

- Section 25 of the Companies Act, 1956

- The Association should have been founded with a commitment to social improvement in India and must have completed three years of operation before applying for FCRA registration.

- To be eligible for FCRA registration, the Organisation must have spent at least Rs. 15 Lakh on its core operations for the benefit of society during the course of the last three financial years.

- Statements of Income & Expenditure duly audited by chartered accountants are to be submitted to substantiate that it meets these financial parameters.

- The Organisation must have utilized at least 80% of the foreign contribution on its core activities. Not more than 20% of the funds can be utilized for administrative expenses. For all administrative expenses beyond 20%, central government clearance is required.

- FCRA registration is compulsory for NGOs that receive foreign donations of more than Rs. 15 lakhs per year.

- NGOs that want to receive foreign donations of more than Rs. 1 crore per year must obtain prior permission from the Ministry of Home Affairs. Easypaytax helps determine eligibility.

Documents required for FCRA registration

The following documents are required to register your NGO under the Foreign Contribution Regulation Act (FCRA), as assembled by Easypaytax:

Normal FCRA Registration:

- Registration Certificate of Association

- Memorandum of Association/ Trust Deed

- The audited statement of accounts for the last three years

- Activity Report for the last 3 years.

- NGO Darpan ID from the NITI Aayog portal

- Aadhaar Card of all the office bearers

Prior Permission FCRA Registration:

- Registration Certificate of Association

- Memorandum of Association/Trust Deed

- Darpan ID from the NITI Aayog portal

- Aadhaar Card of all the office bearers

- Commitment letter from the donor organization and agreement

- Project report for which FC will be received

FCRA Registration Process

The FCRA registration process is a complex one and requires the applicant to be well informed about the complete procedure. Easypaytax simplifies the steps involved in this process:

STEP 1: Visit FCRA Portal

The first step is to access the online portal of FCRA by the Ministry of Home Affairs. Visit the official FCRA website to access the FCRA registration portal.

STEP 2: Create a Login ID

Create a login ID and password. You will need to log on to the FCRA online portal by using the ID and password. Once you log in, click on the new registration or prior permission registration or FCRA renewal.

STEP 3: Fill out the FC-3 Form

Fill out the desired FC-3 form as per your requirements for FCRA registration. Different forms for FCRA are listed in the Table Below:

| Type of FCRA Registration | Application Form |

|---|---|

| FCRA Registration | FC-3A |

| Prior Permission | FC-3B |

| FCRA Renewal | FC-3C |

| FCRA Annual Return Filing | FC-4 |

STEP 4: Upload Required Documents

Upload the required documents for FCRA registration in a prescribed format. Make sure that the documents uploaded are as per the required size provided on the MHA portal. The incorrect format can lead to the cancellation of the application. Easypaytax handles document preparation and upload.

STEP 5: Payment

Finally, you need to pay the required fees for FCRA registration online. The government fees vary accordingly with the type of FCRA registration you are applying for. Easypaytax manages the payment process. Once everything is in order, you'll be registered under FCRA and can start receiving foreign donations.

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.