IEC Registration

IEC (Importer Exporter Code) registration is a key requirement for businesses engaging in international trade in India. It is a unique 10-digit code issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce, Government of India. The IEC serves as a primary identification number for exporters and importers, facilitating their participation in global trade activities. Obtaining an IEC is mandatory for all businesses involved in importing or exporting goods and services from India. It helps streamline customs clearance processes, enables access to various benefits and incentives offered by the government, and enhances the credibility of businesses in the international market.

Import Export Code Registration - Overview

An Import Export Code is a ten-digit unique code provided to an individual/company that is needed for all import/export transactions. The first stage in developing a firm internationally is to export and import goods and services. Trading benefits not just company owners individually, but also the country as a whole. The government has prioritized trade facilitation to cut transaction costs and time.

The Foreign Trade Policy sets forth the government's objective of simplifying import and export processes by improving trade facilitation. These efforts aim to facilitate both import and export commerce, with the primary goal of encouraging company growth. Expanding into worldwide markets is frequently the first step in achieving this aim. Import Export Code (IEC) Renewal is required on a yearly basis for all IEC License holders to ensure compliance and adherence to rules. After receiving an import-export code, exporters can register ports using the ICEGATE site, which is expedited with AD Code Registration. The Foreign Trade Policy brings together several laws that reflect the government's commitment to fostering a favorable environment for import and export activity.

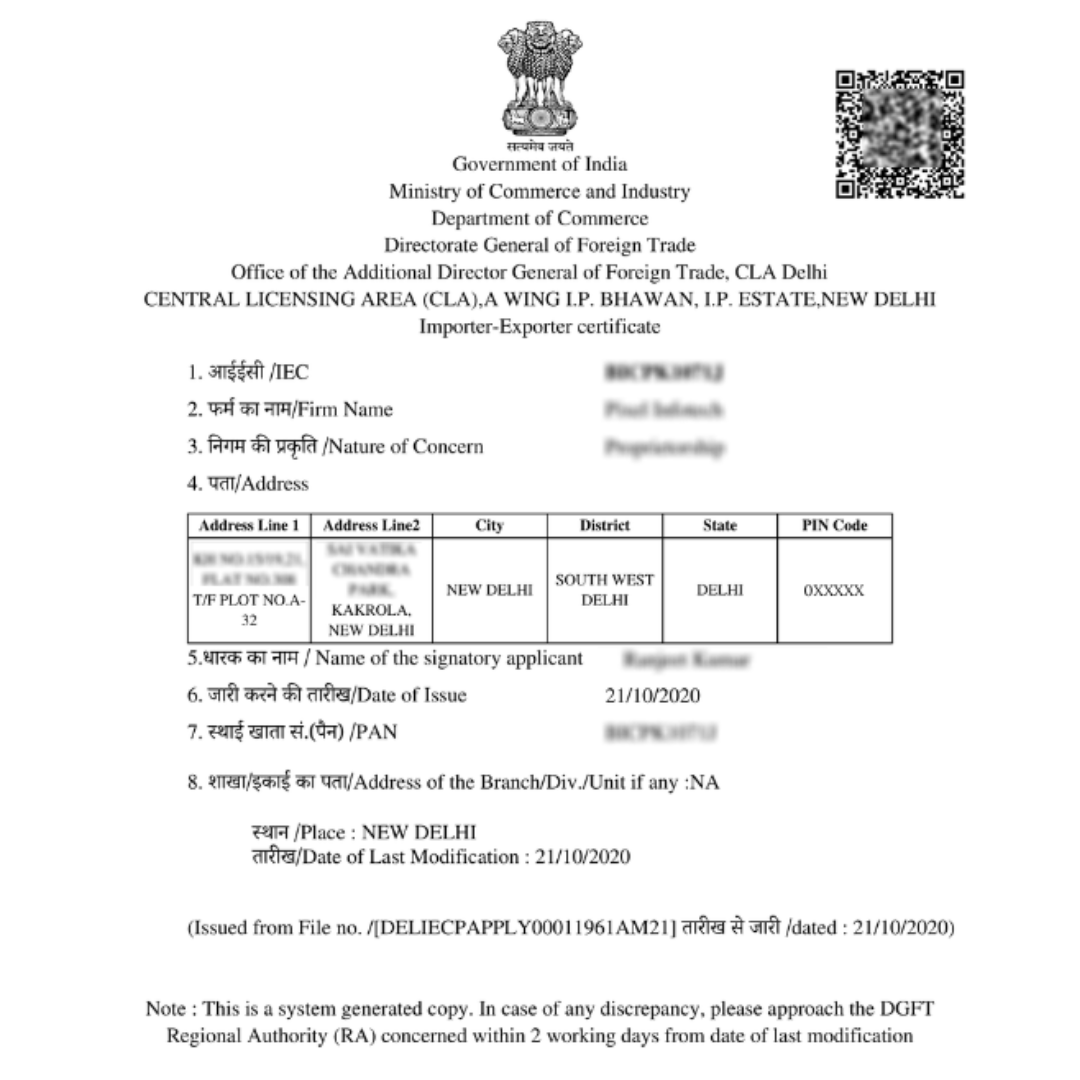

IEC Certificate Sample

What is the Import Export Code?

Import Export Code is a ten-digit unique code assigned to an individual/company and is required for every import/export operation. The DGFT is in charge of issuing import export codes. DGFT stands for Director General of Foreign Trade. Importer Exporter Code is the full form of IEC, although it is more commonly known as import export code.

Unlike other government licenses, the Import Export Code does not need to be renewed on a regular basis. However, one needs to update the status of IEC license on dgft portal on a yearly basis.

Benefits of Import Export License

Since discussion about business can’t be completed without mentioning the profit and the loss. Our focus is to provide legal benefit to your business, so we would be taking the profit portion forward. The government has made trade facilitation a priority in order to minimize transaction costs and time, making Indian exports more competitive. For the benefit of import and export trade, the various provisions of the Foreign Trade Policy and steps taken by the government in the direction of trade facilitation are consolidated.

Want to know how IEC could be useful for your business? Let’s have a look how IEC can help you as an exporter or importer:

1. Overseas Trading:

Import Export Code provides you the facility to expand your business over foreign countries. The basic and most important thing you would need while trading oversea is the Importer Exporter Code. IEC opens your road to expansion and growth on foreign lands.

2. Legalise Business overseas:

The code provides you the license to export your goods and services to any other country and to import the essentials of your business to your own country. It makes your trade over cross borders easy and legal.

3. Online Service:

Now Obtaining IEC could be avail at the ease of sitting home. If you provide accurate and all documents then you could have it at your home. The need to hustle to the government office will not come into the way.

4. Export/Import subsidies:

The government offers benefits such as export subsidies and excise tax concessions in case of import. If the import is completed within the specified time period, some tax relief might be available. In the case of exports, the government offers a subsidy on all the exports taxes. These advantages are only available to those who are enrolled with the IEC.

5. Necessity at Customs:

The importer’s IEC Code must be declared to Customs, and the Bill of Lading must reflect this. All bills of lading for cargo destined for or trans-shipped through Indian ports must include the Indian consignee’s IEC Code.

6. Facilitates Electronic Fund Transfer (EFT):

EFT (Electronic Fund Transfer) is a new service offered to exporters that allows them to submit their license fee via the Internet rather than visiting a bank to make the payment. This procedure is being proposed to make electronic payments more convenient. Only electronically filed applications will be accepted.

Documents Required for obtaining IEC License

Before proceeding to the registration process, let us have information regarding the documents needed to get an Export and export code license online in India. The nature of the firm obtaining an IEC may be any of the following: "Sole Proprietorship, Partnership, LLP, Private Limited Company & Public Limited Company, Trust, HUF and Society."

The documents that would be required are as follows:

- PAN of the business entity

- Address Proof of the applicant’s entity (electricity bill)

- Registration/Certification Number

- Bank account details of the entity with a cancelled check

- Identity proof (Aadhaar Card, Voter ID Card, Passport)

- Passport-size photograph

Minimum requirements for Nidhi Company Registration

- A minimum of seven members is required

- At least three members must be the directors of the company

- A minimum of 10 lakh rupees is required for Authorized Capital

- A minimum of 10 lakh rupees is required for share capital

- Issuing preference shares is not allowed

- The objective of the company should be to receive deposits and lend to its members only.

Procedure for obtaining Import Export License

Step 1. Registration on Government Portal

The very first step for obtaining an Import Export License online is the registration part. One can register online through the government portal of DGFT.

Step 2. Documentation

The very next step after registration is the application phase. All the documents are arranged and prepared for application. You may already know about all the documents required for an IEC application online, as we have discussed earlier.

Step 3. Application for Import Export License

The next step combines the form filling with the document uploading.The “ANF2A” (Aayat Niryat Form 2A) is required to be filled out along with all the necessary documents attached.

Step 4. Verification by DGFT

After submission of your application form, it is sent to the DGFT for verification of the documents. Your application may get approved or rejected based on the documents you have uploaded. So one must be very careful regarding the documents they need to upload.

Step 5. Approval and Issuance of IEC Code

This is the final step in obtaining your import and export code. Once your IEC application is approved by DGFT, your Import Export Code will be issued to you. In the case of an online application, you will get an e-IEC once approved by a competent authority. You will be informed via email that your e-IEC is available on the DGFT website.

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.