Limited Liability Partnership

A Limited Liability Partnership (LLP) is a modern business structure that merges the operational flexibility and tax advantages of a traditional partnership with the limited liability shield of a corporation. In an LLP, partners are not held personally liable for the firm's debts or obligations, thus safeguarding their personal assets. This format is widely preferred by professional service providers like legal, accounting, and consultancy firms. LLPs also benefit from fewer regulatory hurdles compared to private limited companies, making them an ideal choice for small and medium businesses aiming for streamlined management with liability protection.

LLP Registration in India -

Limited Liability Partnership, or LLP, is a progressive business model in India that fuses the features of a private limited company with the partnership’s simplicity. Introduced under the LLP Act of 2008, this structure is tailored for entrepreneurs seeking low-maintenance, low-cost business registration with legal protection.

LLPs are easy to register and operate. A minimum of two partners is required, and there's no upper cap. The rights and duties of partners are defined in the LLP Agreement, which also ensures regulatory compliance. Designated partners hold responsibility for maintaining adherence to legal and procedural norms, providing a sound and accountable governance framework.

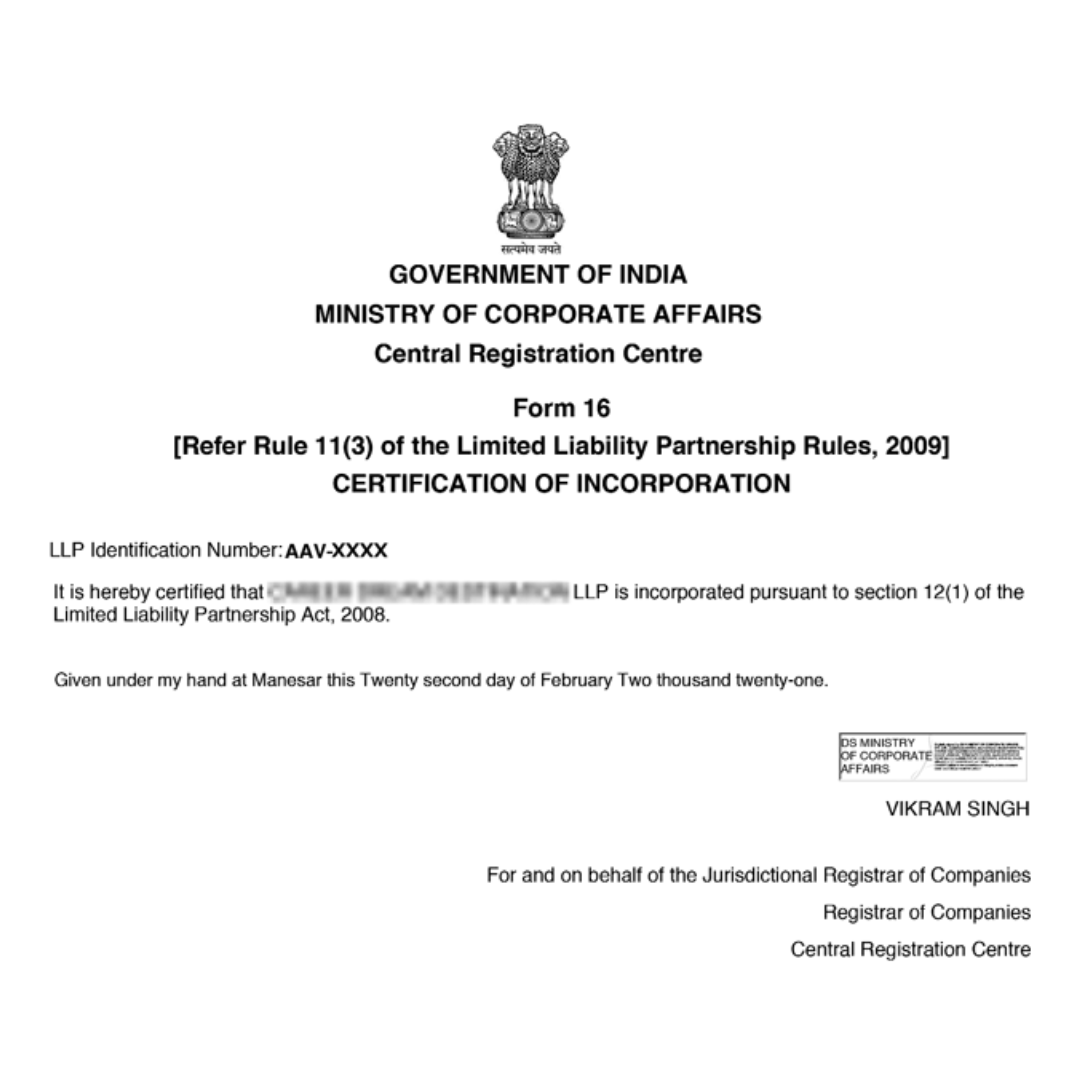

Limited Liability Partnership - Incorporation Certificate [Sample]

Benefits of LLP Registration

The following are the advantages of incorporating an LLP in India:

1. Separate legal entity

An LLP enjoys a separate legal identity from its partners, which means it can own property, enter into contracts, and be sued independently. This benefit is not available in a traditional partnership firm.

2. Limited liability

The personal assets of the partners remain secure, as their liability is limited only to their agreed contribution. This ensures protection from business debts or losses.

3. Lower cost

Registering an LLP through Easypaytax is cost-efficient when compared to incorporating a private limited company, making it ideal for startups and small businesses.

4. No minimum capital required

There is no minimum capital requirement for setting up an LLP. It can be started with any amount, based on the mutual agreement between the partners.

5. Minimal compliance

LLPs are subject to fewer statutory compliances. For example, if the annual turnover remains below ₹40 lakhs, there is no requirement for a mandatory audit.

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

Documents of partners

- ID proof of partners

- Address proof of partners

- Residence proof of partners

- Passport size photograph

- Passport (in case of foreign nationals / NRI)

Documents of LLP

- Proof of registered office address

- Digital Signature Certificate

Checklist for LLP Registration

The following are the requirements for incorporating an LLP in India:

- Minimum two partners

- At least one partner should be a resident of India

- DSC for all designated partners

- DPIN for all designated partners

- Unique name of the LLP that is not similar to any existing LLP, company, or trademark.

- Capital contribution by the partners of LLP

- LLP agreement between the partners

- Address proof for the office of LLP

LLP Registration process

Obtain Digital Signature Certificate

Step 1. Obtain Digital Signature Certificate

The initial step in LLP registration through Easypaytax involves acquiring Digital Signature Certificates (DSCs) for all designated partners. Since the entire incorporation procedure is conducted online, digital signing of forms is mandatory.

All designated partners must obtain a Class-3 DSC, which is issued by certifying authorities approved by the government. These signatures are required to authenticate the electronic documents submitted to the Ministry of Corporate Affairs (MCA).

Application for DPIN

Step 2. Application for DPIN

Each proposed designated partner must apply for a Designated Partner Identification Number (DPIN). This unique number is essential for all individuals who will serve as designated partners in the LLP being registered via Easypaytax.

LLP name approval

Step 3. LLP name approval

To reserve your desired LLP name, Easypaytax will file the LLP-RUN (Reserve Unique Name) form with the Ministry of Corporate Affairs. The name must be distinctive and not match or closely resemble existing companies, LLPs, or registered trademarks.

You may use Easypaytax’s LLP name search tool to verify name availability. This tool generates a list of names that are already in use or similar to your proposed name. If the name meets all MCA criteria, it will be approved by the Central Registration Centre.

Incorporation of LLP

Step 4. Incorporation of LLP

The incorporation application is filed using the FiLLiP (Form for Incorporation of Limited Liability Partnership) form. Easypaytax will assist in submitting this to the Registrar of Companies (ROC) under whose jurisdiction the LLP’s registered office is situated.

The following details are included:

- Registered office address

- State and ROC jurisdiction

- Main business activity code

- Number and details of partners

- Partner capital contributions

- Professional certification by CA, CS, or CMA

Once the Registrar verifies the documents and details, the Certificate of Incorporation is issued in Form-16 within approximately 14 days by the Central Registration Centre.

Filing of LLP agreement

Step 5. Filing of LLP agreement and Partner’s details

The LLP Agreement defines the structure of duties, rights, and responsibilities between the partners and the LLP. This key document must be filed online using Form-3 on the MCA portal.

Additionally, partner details must be filed through Form-4.

- The LLP Agreement must be submitted within 30 days of incorporation

- It must be printed on stamp paper of appropriate value

- Easypaytax ensures timely drafting and electronic filing of both forms

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.