Call Us: +91 889 889 6999

HomeNGO Registration

NGO Registration

NGO Registration

Easypaytax simplifies NGO registration, the formal process by which non-governmental organizations (NGOs) gain legal recognition from government authorities. This process typically involves submitting required documents and fulfilling specific criteria set forth by the governing jurisdiction. Registration grants NGOs legal status, enabling them to operate, fundraise, and implement projects within the legal framework. It also enhances credibility, transparency, and accountability, facilitating partnerships with donors, governments, and other stakeholders. Proper registration ensures compliance with regulations and empowers NGOs to effectively pursue their missions for social welfare, humanitarian aid, environmental conservation, and other causes.

Online NGO Registration

Creating a Non-Governmental Organization (NGO) allows you to work toward the benefit and progress of society. With Easypaytax, you can easily register an NGO once you understand its nature, operations, and registration criteria. There are three types of NGOs: Section 8 companies, societies, and trusts.

Beginning April 1, 2021, all NGOs must complete Form CSR-1 with the Central Government to receive CSR funding, and Easypaytax can help. Furthermore, FCRA registration is essential if the NGO intends to raise donations from overseas sources, and we can guide you through that too.

NGOs serve as catalysts for tackling social challenges, including education, healthcare, environmental protection, and human rights. If you are motivated by a strong desire to make a tangible difference and are determined to promote a cause that resonates with your values, gaining thorough knowledge of the complexities of NGO registration with Easypaytax is a critical first step toward turning your vision into a realistic and meaningful reality.

Section 8 Company

Trust

Society

What is an NGO?

A non-governmental organization (NGO) is a non-profit organization founded by a group of individuals for charity and social goals. The NGO’s mission is to further non-profit objectives such as business, art, science, sports, education, research, social welfare, religion, charity, environmental preservation, and other altruistic causes. An NGO wants to spend all of its income on furthering such goals. Easypaytax helps you navigate the three different categories of non-governmental organizations in more depth.

Types of NGO Registration

There are three types of NGO registration, and each of them is governed by different laws:

- Section 8: Company Registration under the Companies Act, 2013

- Trust Registration under the Trust Act, 1882

- Society Registration under the Societies Registration Act, 1860

Section 8: Company Registration

- Company Registration under the Companies Act, 2013 Section 8 company is the most popular form of NGO registration and has more credibility among donors, government and other stakeholders. It has more benefits than traditional charitable institutions and is registered under the Companies Act, 2013. The main objective of Section 8 company is to promote arts, sports, commerce, science, religion, social welfare, charity and environmental protection. Section 8 company can be registered both as a private limited company and a public limited company.

Trust Registration

- Trust Registration under the Trust Act, 1882 A trust, also known as a charitable trust, is a non-profit organization registered under the Trust Act of 1882. A trust is incorporated as a legal entity where the owner or “trustor” transfers his assets to the second party or “trustee” for the benefit of the third party or “beneficiary”. There are two types of trust: Public Trust and Private Trust. A public trust is created to provide benefit to the general public, and a private trust is created to benefit a particular group of individuals.

Society Registration

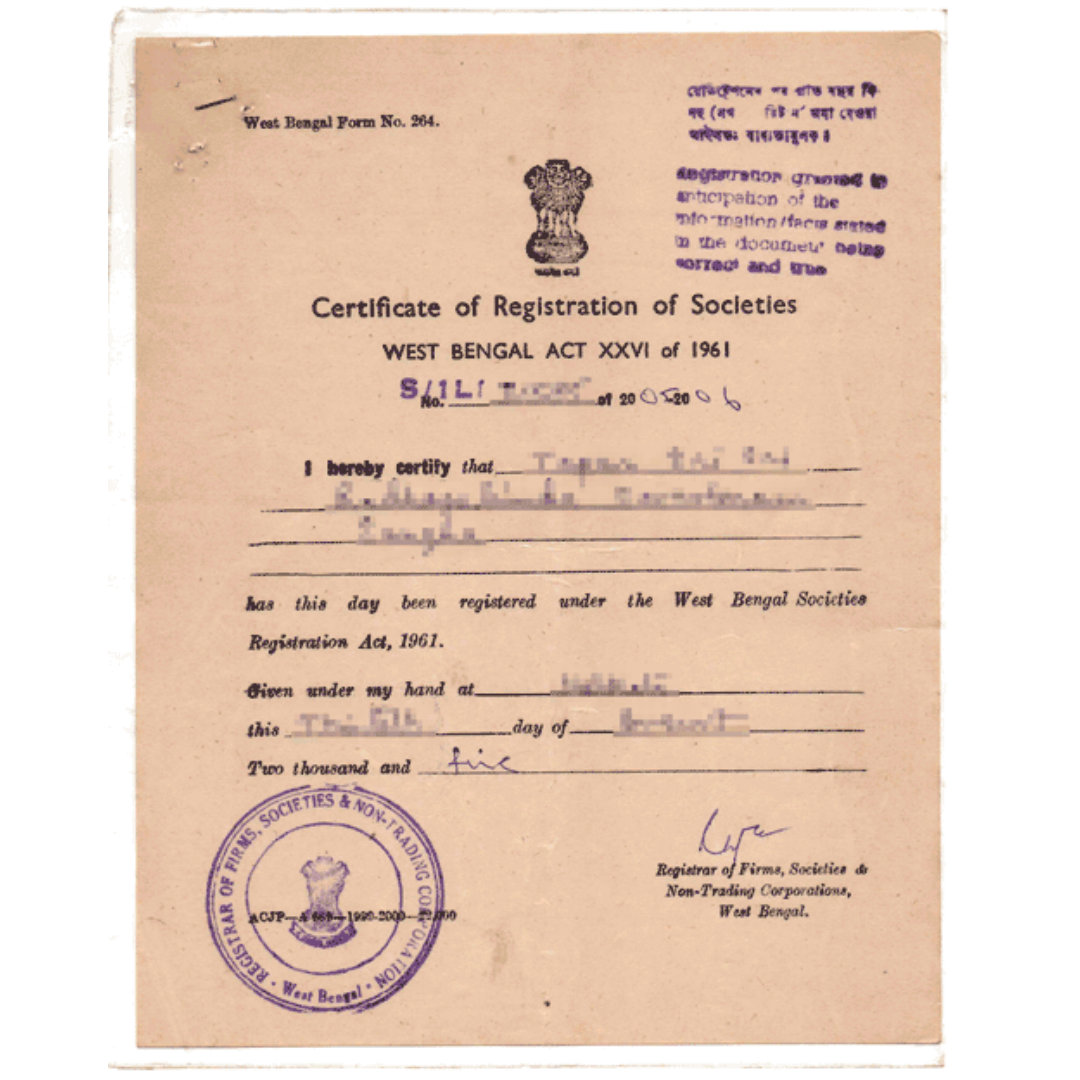

- Society Registration under the Societies Registration Act, 1860 A society is a form of a non-governmental organization created by a group of individuals united for the common non-profit objective of a charitable cause. It is registered under the Societies Registration Act, 1860. All the entity members come together and work towards promoting charitable activities like education, art, science, religion, sport, etc.

Documents required for NGO Registration

Section 8 Company Registration

- Passport size photographs of the directors

- Copy of Aadhar Card

- Copy of Driving License or Voter ID

- Copy of PAN Card

- Copy of latest bank statement or utility bill for address proof

- No objection certificate from the owner of the property

Trust Registration

- Passport size photographs of the members

- Copy of Aadhar Card

- Copy of PAN Card

- Copy of Driving License or Voter ID

- Address proof of office like the latest bank statement or utility bill

- No objection certificate from the owner of the property

Society Registration

- Passport-size photographs of the members

- Copy of Aadhar Card

- Copy of PAN Card

- Copy of Driving License or Voter ID

- Address proof of office, like the latest bank statement or utility bill

- No objection certificate from the owner of the property

Process of NGO Registration

Section 8 Company Registration

Step 1. Application for Digital Signature Certificate (DSC)

Step 2. Application for the Name Availability

Step 3. Application for Section 8 License

Step 4. Filing of SPICe Form (INC-32)

Step 5. Filing of e-MoA (INC-33) and e-AoA (INC-34)

Step 6. Issuance of PAN, TAN, and Incorporation Certificate.

Trust Registration

Step 1. Application for name approval

Step 2. Drafting & Filing of By-laws

Step 3. Approval of Trust Deed

Step 4. Approval of trust registration from the registrar of companies

Step 5. Issuance of the registration certificate and application for PAN and TAN

Society Registration

Step 1. Application for Name Approval

Step 2. Drafting of Memorandum of the Society

Step 3. Filing of Memorandum

Step 4. Approval of rules & regulations of the Memorandum

Step 5. Issuance of the registration certificate and Memorandum

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.