Section 8 Company Registration

Section 8 Company Registration (with Easypaytax) "Section 8 Company Registration" refers to the process of registering a company under Section 8 of the Companies Act, 2013 in India. Easypaytax assists with this. These companies are established for promoting charitable causes, social welfare, science, art, education, religion, and other similar objectives. Unlike other companies, Section 8 companies do not distribute dividends to their members and any profits earned are reinvested into furthering their objectives. This registration requires compliance with specific regulations set forth by the government and typically involves the submission of various documents and forms to the Registrar of Companies.

Section 8 Company Registration

Section 8 business registration is the most common type of NGO registration, with more credibility among funders, the government, and other stakeholders. Easypaytax highlights it provides greater advantages than typical charity institutions and is incorporated under the Companies Act of 2013. The primary goal of the Section 8 corporation is to promote arts, sports, commerce, science, religion, social welfare, charity, and environmental preservation. Section 8 companies can be registered as either private or public limited companies. At Easypaytax, our team of specialists will assist you with registering your Section 8 business in a timely and efficient manner, without you having to worry about the documentation or the registration procedure. We will handle all the documentation and registration procedures and complete the incorporation in the most effective manner possible thanks to our years of expertise in company registration.

Section 8 Company Sample Documents

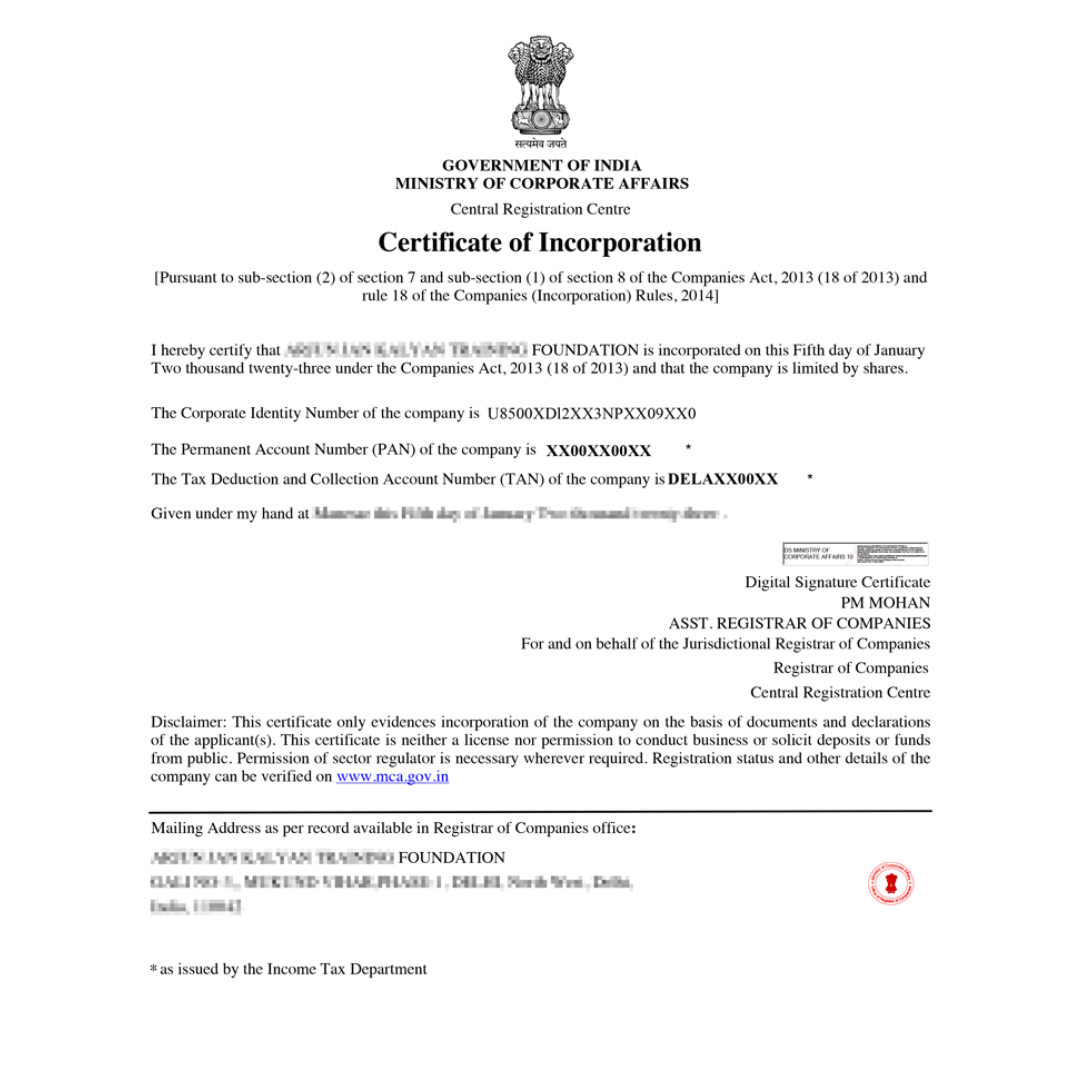

Incorporation Certificate

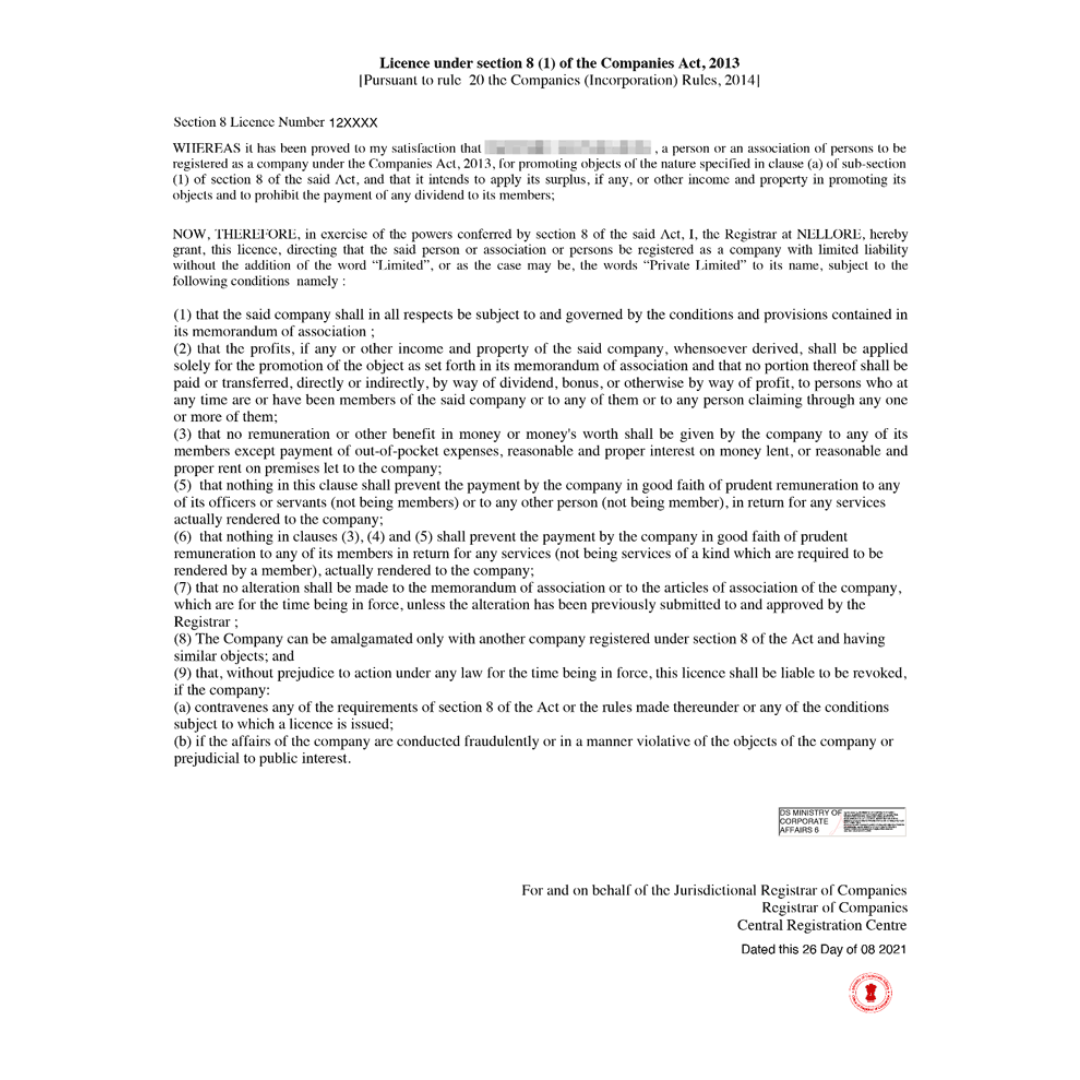

Section 8 License

What is Section 8 Company?

A Section 8 company is an improved version of Society and Trust. It offers several advantages over traditional methods of charity institution registration. Section 8 companies are the most frequent type of NGO registration in India. It is simple to register, operate, and administer.

The primary goal of a Section 8 corporation is to promote non-profit objectives such as commerce, art, science, sports, education, research, social welfare, religion, charity, environmental preservation, and other philanthropic causes.

Beginning April 1, 2021, all NGOs must complete Form CSR-1 on the MCA site to register with the Central Government. MCA has made this Form available on its website and requires any social groups requesting CSR money or CSR implementing agencies to fill it. Easypaytax can assist with the CSR-1 Form, which aims to efficiently track the country’s CSR spending.

Benefits of Section 8 Company registration

Eligible for grant and donations

The companies registered under Section 8 become eligible for various grants offered by the Government of India. Further, Section 8 Companies are also entitled to receive donations from the public.

Exemption to the donors

Those donating to a Section 8 Company are eligible for tax exemptions under 80G of the Income Tax Act.

Tax Benefits

There are many tax benefits for Section 8 companies in India.

Separate Legal Entity

The identity of the Section 8 Company and its directors are separate which means the entity will continue to survive, even if all the directors of the company become incompetent to carry on the business.

No Minimum Capital

There is no requirement of minimum paid-up capital for the Section 8 Company registration.

Credibility

Section 8 Company creates their credibility in the market by holding the license issued by the ROC and the various kinds of activity undertaken by them.

Section 8 License

The Registrar of Companies provides a License to Section 8 Companies in Form INC-16. Easypaytax can help you leverage these benefits.

Documents required for Section 8 Company registration

As per the Companies Act 2013, you need to provide proper identity and address proof to be submitted on the Ministry of Corporate Affairs (MCA) portal for Section 8 company registration.

Identity and Address Proof of Directors/Shareholders

- Passport size photographs of the directors

- Copy of Aadhar Card

- Copy of Driving License or Voter ID

- Copy of PAN Card or Passport (in case of foreign national or NRI)

- Copy of latest bank statement and utility bill

Address Proof of Registered Office

- Copy of electricity/water/gas bill (not older than two months)

- Rent agreement in case of rented office

- No Objection Certificate (NOC) from the owner of the property

Minimum requirements for Section 8 Company registration

- A minimum of two directors is required if a Section 8 company is incorporated as a private limited company

- Minimum 3 directors in case of incorporation as a public limited company

- At least one director should be a resident of India

- Registered office address

- The objective of the company should be for charitable or social purposes only

- The profit cannot be shared among shareholders

Procedure of Section 8 Company registration

Digital Signature Certificate

Step 1: Apply for a Digital Signature Certificate

Section 8 Company incorporation is a complete digital process, and therefore the requirement of a digital certificate is a mandatory criterion. Easypaytax assists directors, as well as subscribers to the memorandum of the company, to apply for a DSC from the certified agencies. Obtaining a DSC is a completely online process, and it can be done within 24 hours. This process involves 3 simple verifications: document verification, video verification, and phone verification.

Name Approval

Step 2. Application for the Name Availability

Name application for Section 8 Company can be done through SPICe RUN form which is a part of SPICe+ form. While making the name application of the company, industrial activity code as well as object clause of the company has to be defined.

Note: Easypaytax ensures it should be ensured that company name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950). You can easily check the name availability by using our company name search tool to verify the same.

Section 8 License

Step 3. Application for Section 8 License

For obtaining the license under Section 8 Company, Form INC-12 is required to be filed with the Registrar of Companies. Prior to issuance of Certificate of Incorporation for Section 8 company, approval letter under Section 8 of Part 1 i.e, License under Section(1) of the Companies Act, 2013 is issued from the Ministry of Corporate Affairs. Once the form is approved by the Central Government, ROC will issue a 6-digit Section 8 license number.

Filing of Form (INC-32)

Step 4. Filing of SPICe Form (INC-32)

After name approval, details concerning the registration of the company have to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. Easypaytax assists with the details in the form, which are as follows:

- Details of the Company

- Details of Members and Subscribers

- Application for Director Identification Number (DIN)

- Application for PAN and TAN

- Declaration by Directors and subscribers

- Declaration and certification by Professional

Filing of e-MoA and e-AoA

Step 5. Filing of e-MoA (INC-33) and e-AoA (INC-34)

(INC-34) SPICe e-MoA and e-AoA are the linked forms that must be drafted at the time of application for company registration, and Easypaytax can help.

A Memorandum of Association (MOA) is defined under Section 2(56) of the Companies Act 2013. It is the foundation on which the company is built. It defines the constitution, powers, and objects of the company.

The Articles of Association (AOA) are defined under Section 2(5) of the Companies Act. It details all the rules and regulations relating to the management of the company.

Issuance of COI

Step 6. Issuance of COI

After approval of the above-mentioned documents from the Ministry of Corporate Affairs, a PAN, TAN, & Certificate of Incorporation will be issued by the department concerned. Now, the company is required to open a current bank account by using these documents. You can contact Easypaytax for assistance with your current bank account opening.

A FinTech platform that understands your need

A comprehensive package of services for starting and managing your whole business, offered to you by a firm with a long-term goal to improve the way you do business.